2024 Portfolio Check Up

Objectives of the Portfolio Check Up

It's time for my annual portfolio checkup, where I assess whether to increase, hold, sell, or trim positions.

I covered my 2023 performance in a separate article.

I decide to sell based on the following criteria:

Valuation: If a stock reaches an exceptionally high valuation compared to its historical norms.

Better Opportunities: When a more enticing investment option becomes available.

Loss of Competitive Advantage: If a business loses its competitive edge.

Portfolio Balancing: To limit exposure when a stock becomes too large a percentage of the overall portfolio.

My investing approach involves seeking high-quality companies that can be held for years, acquired at attractive prices often stemming from temporary problems. The crucial consideration is whether the issues are temporary if they’re a permanent impairment.

I prefer holding stocks for at least a year, and ideally, much longer, allowing the business to compound over time.

However, I'm not a 'never sell' investor.

I recognize the importance of selling based on valuation and business performance.

On the valuation front, many businesses grew to be insanely overvalued in an environment like 2021. It’s important to sell when it’s clear that Mr. Market is manic. He’s eventually going to come down from the high.

On the business performance front, a good investor is generally right only 60% of the time, meaning that I’m going to be wrong about some of the businesses that I own. In a portfolio of high quality large caps, it’s important to sell when it’s clear that I bought a Kodak or GE.

While I make adjustments throughout the year, the annual check up allows me to make informed decisions about each position's status in the portfolio.

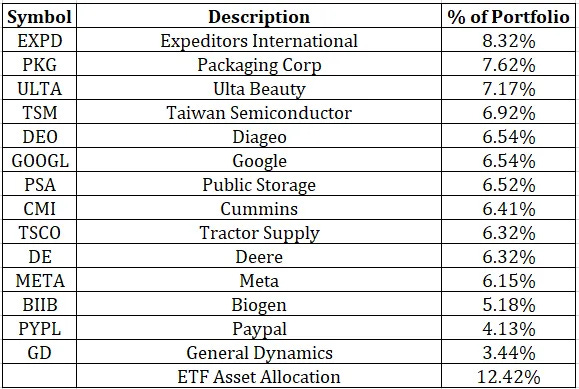

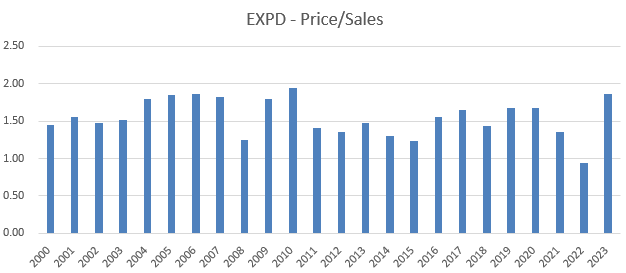

On 1/1/24, this was was my portfolio:

Post-checkup activity, this is my portfolio:

I sold out of General Dynamics, reduced Expeditors, and reduced Packaging Corp.

The proceeds of these sales were used to buy a new position - Dollar General - and slightly expand the allocation to my ETF Asset Allocation.

All of my sales & trimmed positions were due to valuation. I think that the competitive advantages are still intact for every company in the portfolio. I didn’t sell anything in reaction to a deteriorating moat.

Below is my analysis of each position and the decision made:

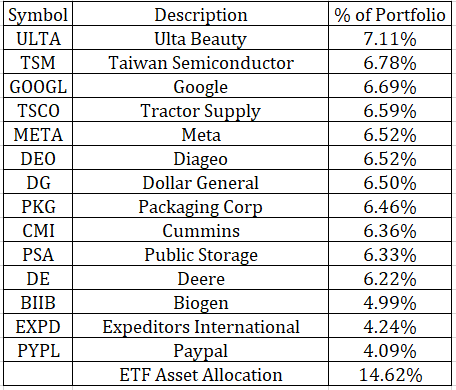

Dollar General

Decision = Buy. New addition to the portfolio.

Purchase Price = $133.33

Current Price = $134.64

Gain/Loss = +.98%

Purchase Date = 1/11/24

I added Dollar General to my portfolio this week. In June 2023, I evaluated Dollar General when the stock was priced at $163 but opted not to invest due to concerns about its valuation.

Another reason I didn’t buy immediately in June was my experience with Meta and Google. They taught me a valuable lesson – it's wiser to exercise patience rather than buy after the first immediate decline. Both investments worked out, but they would have worked out a lot better if I had more patience.

Not much seems to have shifted with Dollar General since my initial analysis in June last year. The moat remains intact, primarily rooted in their robust presence in rural areas. Dollar General frequently stands as the sole retailer in a rural setting, offering convenience for those who prefer not to drive 30 miles to the nearest Walmart.

Interestingly, despite the stock's decline, revenues have been on a steady rise. The business is not on a downward trend but rather expanding through new store openings.

Although same-store sales have dipped slightly, the concerns causing investor anxiety mostly revolve around shrinking margins. Inflation is driving up COGS, and a low unemployment rate is increasing labor costs. I view these challenges as mostly cyclical, not long-term.

This is an ideal scenario. The stability of revenues indicates that the business is not undergoing a terminal decline. The stock price is reacting as if the business is in terminal decline. Meanwhile, it is easier for management to enhance margins and reduce costs than rescue a declining business. The challenges faced by the business are temporary, while the market extrapolates the current situation into the future.

Investors are also fixating on the store conditions. Being a bit obsessed about the stock, whenever I drive by a Dollar General, I pop in to check it out. Having visited a few stores, I've noticed a range – newer stores are well-maintained, while older ones look sloppy.

The stock downturn prompts investors to focus on the less favorable cases. When it’s a consensus compounder again, investors will focus on the shiny new stores.

Investors are losing sight of the fact that this is a dollar store. No one is going into a dollar store expecting it to look like Tiffany’s on Fifth Avenue. People are going to Dollar General for items like laundry detergent and a box of Mac and Cheese. The alternative is driving an hour away to Wal-Mart.

There's also concern about Dollar General's growth prospects. Over the past decade, the company expanded its store count rapidly. Now, there is a concern that they have saturated the United States.

This might be true. However, Dollar General doesn't need extensive growth to perform well from the current price. Prioritizing shareholder yield, normalizing margins, and organic growth in same-store sales can lead to positive outcomes for investors.

My primary concern centers on Dollar General's substantial debt, reflected in their elevated debt/equity ratio of 280%, surpassing my usual comfort zone. Despite this, their interest coverage is sufficient to manage the debt burden. The opportunity at hand justifies the risk. I’ve also made the position relatively small amid a portfolio of companies with very low debt levels.

The stock is down 43% in the last year and it appears to be a classic case of excessive pessimism due to temporary issues.

General Dynamics

Decision = Sell

Sale Price = $144.8

Current Price = $253.77

Gain/Loss = +75.25%

Purchase Date = 10/12/20

Sale Date = 1/9/24

General Dynamics is an impressive company, but I decided to sell it due to concerns about its valuation. Despite this, the company is fundamentally strong, showing solid and decent growth in the past year. Earlier concerns this year about the company's ability to handle supply chain issues have been successfully navigated.

General Dynamics maintains a robust moat, remaining one of the two major military shipbuilders alongside Huntington Ingalls (a company that I'll cover on this website soon).

Defense companies are fantastic businesses. The US military is the best customer in the world, as they can literally print money and world peace doesn’t look like it will happen anytime soon.

Currently, the stock is trading at 1.7 times its sales, which is historically on the higher side. The forward P/E has also increased to 16.7 times, which is relatively high for this stock. General Dynamics is a slow grower. At higher multiples, the future returns are significantly reduced.

The business has a cyclical element with the Gulfstream segment, which has been thriving in recent years. I prefer not to hold investments in cyclical industries following a period of robust performance.

Additionally, I believe the recent increase in the stock (it’s up 17% since the onset of the Israel-Hamas war) is a knee jerk reaction to the war rather than a result of any fundamental improvement in the business. After all, nuclear submarine sales aren’t going to increase because of the Israel-Hamas conflict.

Despite selling now, it remains on my watchlist of wonderful companies. I will be back when investors sour on it again.

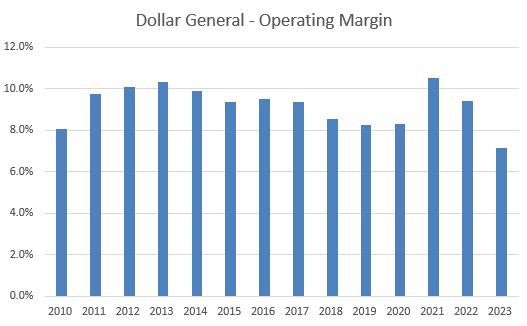

Expeditors International of Washington

Decision = Trim

Purchase Price = $109.5

Sale Price = $125.34

Gain/Loss = +14.46%

Purchase Date = 2/7/22

Trim Date = 1/9/24

Expeditors International has undergone significant revenue fluctuations in recent years, from $9.5 billion in 2020 to a peak of $17 billion in 2022, and a subsequent dip to $10.4 billion in the last twelve months.

The 2020-21 surge, triggered by substantial government stimulus, led to heightened consumer goods demand and supply chain disruptions. Expeditors navigated these challenges, capitalizing on increased freight rates and high volume.

As the boom subsides, returning to a more normalized pre-COVID state, freight rates have decreased. While the company's long-term prospects remain promising, it's unlikely to witness a boom of similar magnitude in the near future.

Expeditors’ moat remains intact. EXPD still holds a formidable position with global reach and established customer relationships, making it challenging for competitors to replicate. The company's extensive network of offices worldwide strengthens its ties with shippers. Clients value EXPD's size, reliability, and ability to navigate complex logistics and customs issues. The deep organizational knowledge makes it immune to technological disruption. They also have a fantastic culture where managers maintain an entrepreneurial mindset.

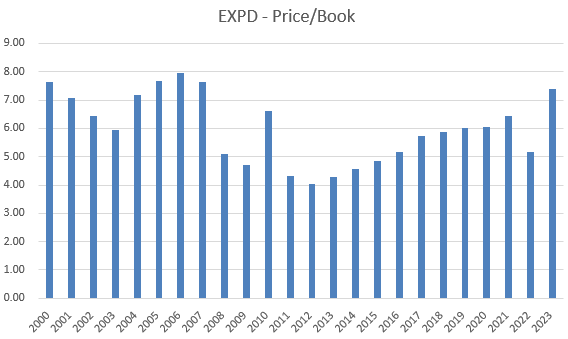

The stock is presently positioned at the upper limit of its usual valuation levels, standing at 1.86x sales. Given the revenue fluctuations in recent years, looking at price/book is helpful, as book values offer more stability for EXPD than sales. The price/book value is relatively high.

Due to valuation alone, I trimmed the position but still keep it within my portfolio.