2023: Performance & Activity Update

Performance

As of the end of 2023, my active account tracked on this substack showed a gain of 27.46%. In comparison, global stocks, represented by the VT ETF, closed the year with a 22.02% increase, while the S&P 500, tracked by the SPY ETF, recorded a total return of 26.19%.

Last year, I lost 13.52%, also slightly outperforming the VT and SPY benchmarks, which incurred losses of 18.01% and 18.17%, respectively.

Over the past couple of years, my performance has slightly exceeded those benchmarks.

Despite receiving some criticism for my choice of benchmarks, I think that VT and SPY are fine. I tend to deal in large caps (that’s where the best moats are), and that’s what those indexes represent.

I am not sure if there is a decent benchmark for a portfolio of 13 high-quality companies acquired at attractive valuations combined with an asset allocation strategy that uses real estate, small cap value, international small caps, gold, and long-term treasuries.

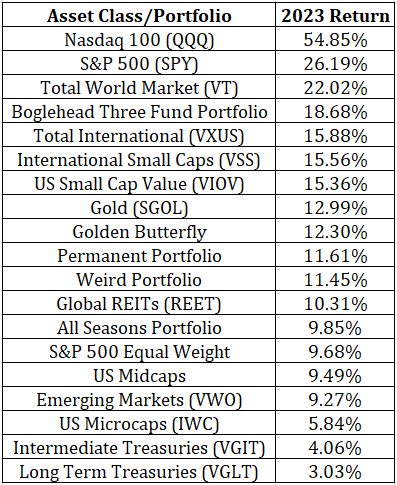

For a total look, here is how various asset classes and portfolios performed last year. The ‘weird portfolio’ is my asset allocation that I use instead of holding cash.

Macro

A year ago, this is what I wrote about the macro situation:

Heavy questions weigh on investors’ minds. Will the Fed be able to defeat inflation? Will the aggressive tightening result in a recession this year? How deep & lasting will the recession become, and how will the markets respond to it? Will the Fed continue tightening? Will the Fed cause a terrible deflationary recession, and will they go back to ZIRP and aggressive easing to fight it? Will the Fed engineer a soft landing where inflation eases and the economy keeps roaring, as Greenspan did in 1995, and led him to be declared a maestro?

If you’re expecting answers to these questions, you’re reading the wrong substack.

A year later, it appears that the Federal Reserve has successfully managed to curb inflation, or at least pushed it back a notch. Their tightening measures did not lead to a recession and inflation has retreated from 8.3% in 2022 to a more manageable 3.1%. This unexpected turn of events was the driving force behind the frenzy in the stock market.

This outcome has defied the expectations of many. Conversations with individuals a year ago predominantly fell into two camps: 1) those anticipating a recession with the Fed eventually resorting to Zero Interest Rate Policy (ZIRP), and 2) those predicting uncontrollable inflation with rising interest rates.

Anyone forecasting a soft landing likely would have faced considerable skepticism, but that’s what happened. Bulls always sound naive and bears always sound smart.

Meanwhile, 2020-21 looked like a speculative frenzy which fell apart in 2022. Most people I talk to thought that 2022 was something like 2000, the beginning of the end for a speculative cycle. I agreed with them.

Instead, with the renewed bull market, the speculative frenzy kicked back into high gear. Among aggressive investors, QQQ rallied nearly 55% after falling 32.58% in 2022. Among even more aggressive investors, ARKK increased 69% after falling 67% in 2022.

The gains from the past year were predominantly centered around the leading technology stocks. The enthusiasm surrounding artificial intelligence translated into remarkable gains, with Nvidia witnessing an astonishing 239% surge.

On the flip side, adopting an equal-weighted approach to the S&P 500—typically mirroring the broader index movements—yielded a more modest 9.68% gain, trailing the overall index's robust 26% increase.

Investors are now grappling with the looming question of whether the party will persist and if the tech sector can continue the gains witnessed in 2023. There's also a concern that the anticipated recession, which failed to materialize in 2023, might happen in 2024, potentially leading to a significant downturn in stocks.

As is customary, investors find themselves wrestling with the classic dilemma of FOMO (Fear of Missing Out) vs. the fear of losses, a struggle often influenced by their personalities.

My position? I don’t know.

My strategy involves pinpointing high-quality businesses that can perform well across an entire economic cycle.

The purpose of this substack is to identify these businesses by investigating a company ever single week. Often, the companies are too expensive when I first look at them. My goal is to acquire these companies when they face temporary setbacks and are available at attractive valuations. I sell if the business seems impaired or if its valuation is stretched. I don't even try to predict macroeconomic conditions.

In simpler terms, I expect a severe recession to kick my ass eventually, but I don't believe I can accurately forecast when it will occur. To survive these events, I invest in businesses that exhibited resilience in the face of past recessions, have low debt, resilient cash flows, and possess an economic moat.

Additionally, I steer clear of investing in stocks with bubbly valuations, as these often suffer the most during bear markets. The leaders of a bull market are often led to the guillotine during the next bear.

I’ve tried the game of macro prediction and have utterly failed at it, so I don’t do that anymore. This is a lesson you learn with experience and you either wind up admitting it’s unpredictable or you develop a deep seated hatred of the Federal Reserve.

I believe this approach can deliver strong performance over the long term without the need for a crystal ball or advanced trading skills. After all, I don’t have a crystal ball or advanced trading skills. I don’t think anyone else does, either, but that’s another topic for another time.

Q4 Trades

In the past quarter, I executed the following trades: