West Pharmaceutical Services (WST)

Key Statistics

EV/EBIT = 32.3x

ROE = 17.7%

Debt/Equity = 11%

FCF Yield = 1.6%

Dividend Yield = .32%

Market Cap = $17.76 billion

The Company

West Pharmaceutical Services helps make injectable medicines safe and effective by designing and producing the packaging and delivery systems those medicines rely on. This includes things like rubber stoppers, seals, plungers, syringes, vials, and even advanced self-injection devices like auto-injectors.

These components might seem simple, but they play a vital role in making sure medicines like vaccines, insulin, and cancer therapies stay sterile, stable, and easy to administer. West doesn’t just sell products—it also provides technical support and laboratory services to help its customers meet safety standards and regulatory requirements. That combination of physical products and expert support makes West a key player in the global pharmaceutical supply chain.

Most of West’s customers are large pharmaceutical and biotech companies that make injectable drugs. These customers rely on West for reliable, high-quality components that are both low-cost and essential to their operations. Since these products are single-use and tied directly to drug production, pharmaceutical companies order them over and over again. This creates a business model that’s predictable and steady. West benefits from strong customer loyalty, minimal pricing pressure, and the ability to charge premium prices for its higher-end, value-added products.

The company’s story begins in 1923, when Herman O. West founded The West Company in Philadelphia. It started by making rubber plungers for dental cartridges. As the pharmaceutical industry began to grow, West adapted, adding aluminum seals and other packaging parts. During World War II, it partnered with Eli Lilly to provide rubber closures for penicillin—a major breakthrough at the time. That ability to anticipate market needs and build strong partnerships would shape West’s future.

In 1970, the company went public on the New York Stock Exchange, under the ticker symbol WST.

As the decades passed, West expanded far beyond rubber parts. By the late 20th century, it was already developing more advanced drug packaging and delivery solutions. But in January 2003, the company suffered a major setback when a dust explosion at its Kinston, North Carolina plant killed six people and injured dozens more. The accident prompted a federal investigation and forced a full rebuild of the plant. It was a turning point that brought renewed attention to safety and operational excellence within the company.

Between 2004 and 2019, West grew steadily. It expanded globally, invested in research and development, and developed new proprietary technologies like FluroTec®, which reduces the chance of a drug reacting with its packaging, and Envision™, an automated vision system that checks for defects. It also expanded into contract manufacturing, helping other companies develop and produce medical devices. This era saw consistent revenue growth and a stronger focus on innovation. By the end of the 2010s, West had positioned itself as not just a supplier, but a strategic partner for pharmaceutical companies.

Then came the COVID-19 pandemic, which became a major tailwind for the company. West’s components were suddenly in extremely high demand as vaccine production ramped up across the world. The company’s role as a trusted supplier of high-quality packaging components—especially rubber stoppers and seals for vaccine vials—meant that it became essential to the global pandemic response. Business boomed. Operating margins, which were 16.2% in 2019, rose sharply to 26.4% by 2022. West added capacity, accelerated production, and saw its revenues and profits surge.

But once the urgency of the pandemic faded, so did the extraordinary growth. Vaccine orders dropped, customers started using up inventory, and fewer new short-term orders came in. Margins fell back to 20.4%, and the company entered a period of normalization. As a result, West’s stock—which had soared during the pandemic—pulled back significantly. Investors adjusted their expectations, but the company’s long-term fundamentals remained solid. Its products are still essential, its customer relationships are strong, and it continues to benefit from global demand for injectable therapies.

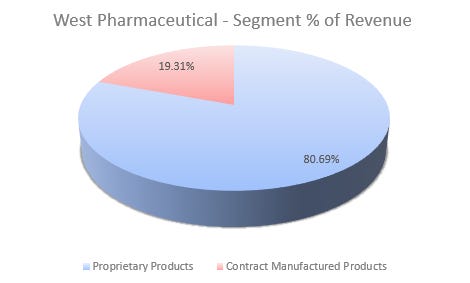

Today, West operates through two main business segments: Proprietary Products and Contract Manufactured Products.