Visa (V)

Key Statistics

EV/EBIT = 24.69

ROE = 48.11%

Debt/Equity = 54%

FCF Yield = 3.4%

Dividend Yield = .76%

Market Cap = $550.03 billion

The Company

Visa (V) is one of the largest payment processors in the world. It facilitates electronic payments for individuals and businesses worldwide.

While they don't directly issue credit cards or set fees, they collaborate with banks to provide Visa-branded cards for transactions. Visa handles an impressive volume of transactions annually, totaling trillions of dollars.

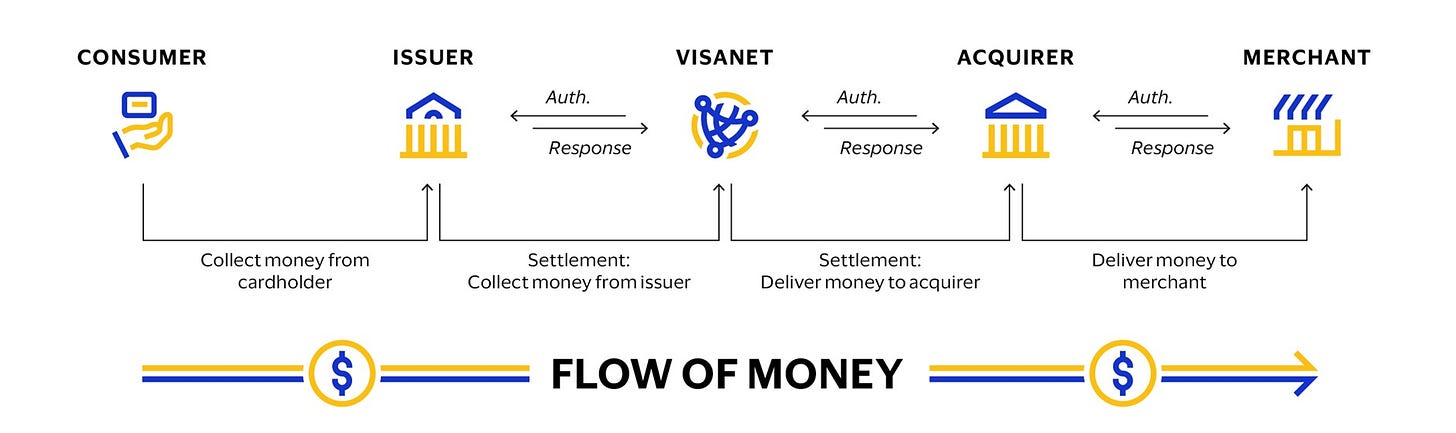

Their business model is clear-cut: when a consumer uses a Visa card, the transaction data undergoes several stages. Initially, the merchant forwards the data to an acquirer, typically a bank or processing firm. From there, the information flows to Visa through their secure network, VisaNet. Visa then verifies the transaction with the issuer, usually a bank, ensuring the consumer has adequate funds or credit. Once approved, the issuer records the transaction and compensates the acquirer, deducting a fee. The acquirer, in turn, pays the merchant after levying another fee.

Unlike traditional banks, Visa doesn't directly extend credit to consumers. Instead, Visa primarily serves as the infrastructure for electronic payments, offering a network through which transactions flow securely. Visa earns revenue by collecting fees based on the volume of transactions processed through its network.