Trump, Tariffs, and the Case for Doing Nothing

Since launching this Substack, we haven’t really seen a full-blown market meltdown.

The dip in 2022 was relatively mild—a chance to scoop up cheap tech stocks more than anything else.

But what we’re seeing now? This has the potential to turn into a true mega bear market—down 40% or more.

It's still uncertain, which is exactly why I no longer try to time the market. But the drift in that direction is becoming increasingly likely.

And now that we might be in it, I’ve got a lot to say.

I’ve made a point of keeping politics out of this space. But that’s no longer possible, as politics are at the core of what’s happening right now.

What’s happening is political—and it’s wreaking havoc on the markets.

So let’s talk about it.

My Biases, For the Record

I’m a conservative.

Not in the Alex Jones/Fox at full volume kind of way. More like the Reagan-Friedman-Sowell variety. Fiscal discipline, free minds, free markets, and a strong military.

I became a Republican back when Republicans were still free market oriented and didn’t need to embrace populism/nativism/protectionism to score votes. I’m one of those nearly extinct fiscally conservative/socially liberal Republicans from the 1980’s and 1990’s.

I embraced this philosophy when I was a teenager.

I was the teenage nerd reading Free to Choose by Milton Friedman. I fell in love with Reaganomics before I knew how to drive.

Reagan made sense to me. He inspired me. He said, “Government is not the solution to our problem; government is the problem”—and I was all in.

And say what you will, but it worked. The U.S. economy in the ‘70s was a train wreck—stagnation, inflation, misery.

Then came Reagan: tax cuts, deregulation, Volcker’s iron spine on rates. The economy flourished. And he didn’t just revitalize the U.S.—he helped end Communism and exported capitalism around the globe.

Even Clinton continued the Reagan-era policies. He cut spending. He reformed welfare. Free trade was a bipartisan article of faith.

(A Republican Congress largely pushed Clinton in this direction - but let’s give credit where credit is due.)

The Reagan consensus held all the way through the ‘90s and into the 2000s.

But that consensus is gone now—blown apart by the financial crisis, Occupy Wall Street, MAGA, and the populist fever swamp. And what’s taken its place? Tariffs. Nationalism. Managed trade. A rage against globalism.

Revisionist Economic History

These days, it’s trendy—especially on the left and among the Buchananite wing of the Trump-era right—to blame capitalism for everything. Trade gutted the Rust Belt. Billionaires and the ‘globalists’ hoarded all the gains. Reagan, Bush, & Clinton sold out the working class. Blah, blah, blah.

Sure, if you were working the line at a steel mill in Youngstown, things were bad. No question.

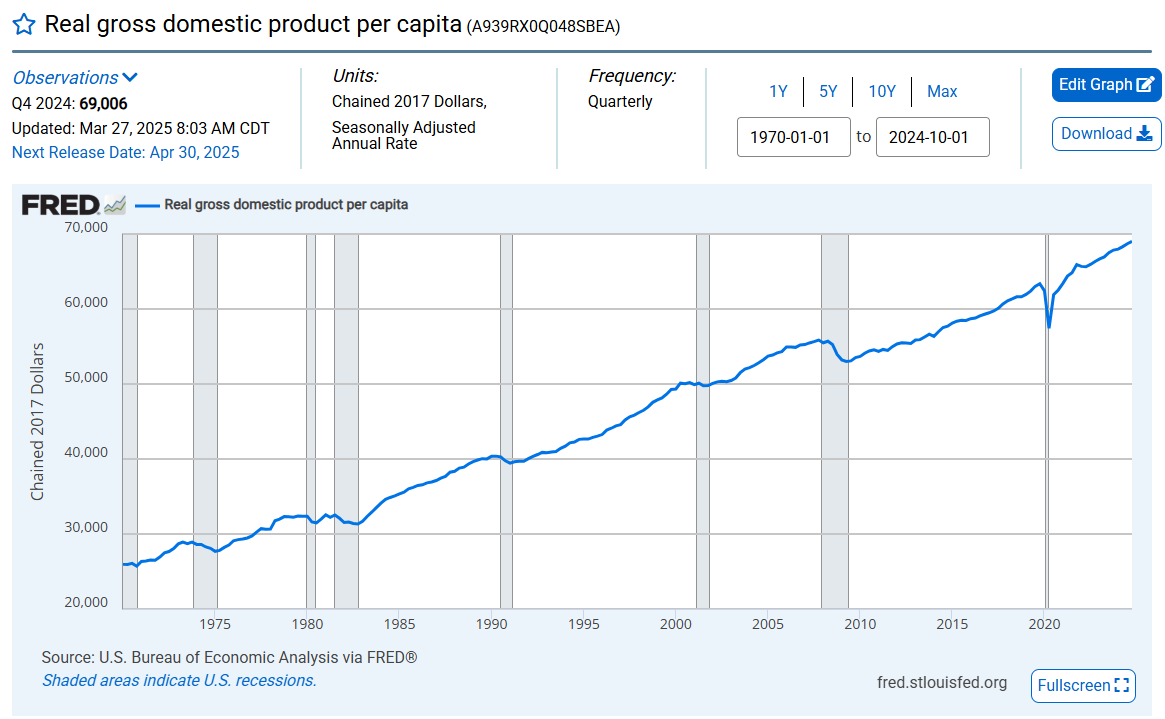

But for most Americans? They didn’t get crushed—they leveled up. The middle class didn’t disappear—it got richer.

The ladder didn’t break; people climbed it. They embraced higher wage, high skill occupations.

Household incomes went up. Household net worth expanded.

We had decades of strong growth, low unemployment, and rising living standards. That’s not spin—that’s just what happened.

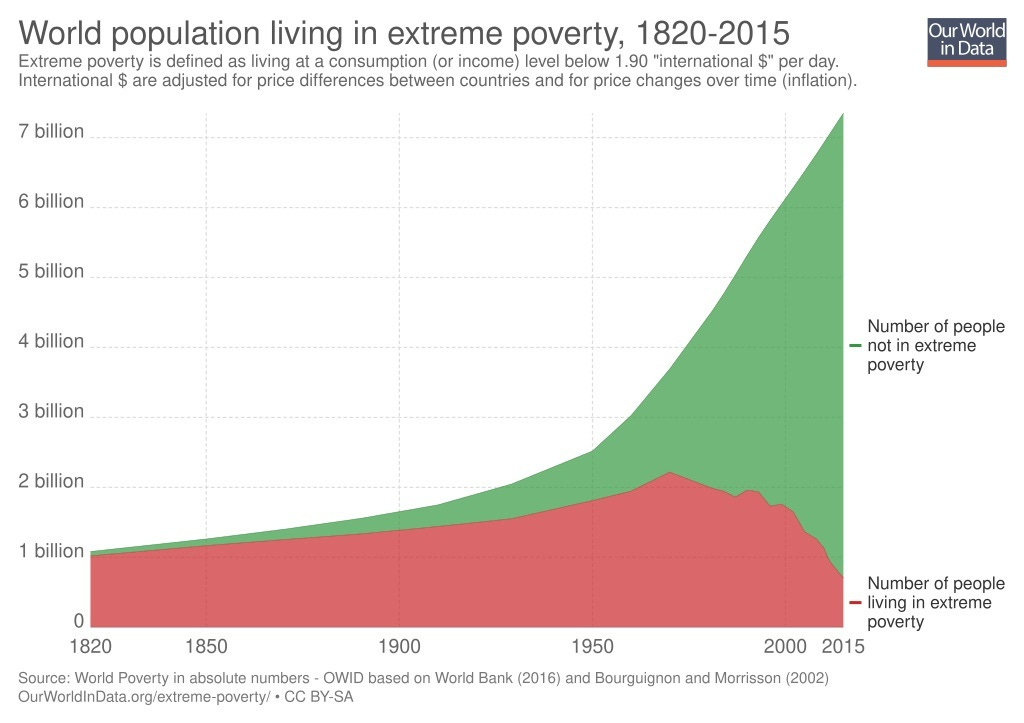

Globally, free markets and free trade didn’t wreck the world. They saved it. Poverty dropped to the lowest levels in human history. A global middle class emerged where none had existed before.

And if the data doesn’t convince you, just use your own life as the benchmark. You probably live in a bigger house than your parents did. You eat better food. You have cooler gadgets. You travel more. You fly for fun. Your fridge doesn’t leak Freon. Your car actually starts in the winter.

Many on both the right and left have bought into a nostalgic myth—that the middle class was thriving and life was better “back then.”

But it wasn’t.

In 1959, often romanticized as the peak of the American Dream, the poverty rate was a staggering 22.4%. Today, it's 11.1%.

People often pine for a time when one income could support a family.

Well, technically, you could still do that today—on about $30,000 a year if you live a 1950’s middle class lifestyle.

The difference? No one wants to live like it’s 1959 anymore. Families back then rarely traveled, ate almost every meal at home, owned one car (maybe), and had one black-and-white TV, if that.

And here’s the kicker: even that modest lifestyle wasn’t accessible to most. With nearly a quarter of Americans living in poverty, the postwar “golden age” wasn’t golden for everyone.

The Leave It to Beaver and Happy Days version of the past—where the middle class was booming and life was simpler—isn’t history. It’s fiction. It’s looking at the past through the lens of TV sitcoms.

Enter Trump, Stage Right

I knew who Trump was long before he came down the escalator.

I read The Art of the Deal in the 1990’s as a teenager and admired him before I realized it was mostly fiction. The guy inherited a nine-figure fortune and nearly blew it—multiple times.

During the 1990s, American banks had recognized Trump as a major financial risk and largely cut ties—leaving Deutsche Bank as one of the few institutions still willing to do business with him.

He’s not a business genius. He’s a brand. A brand that has been reinforced through total fiction like The Art of the Deal and The Apprentice.

When he started talking tariffs in 2016, I was done. That was it. I couldn’t vote for him. I broke my streak—first time I didn’t vote Republican since I started voting when I was 18 in 2000.

I voted for Hillary Clinton mainly because I was worried about his stance on tariffs. Tariffs are an economic sin. They’re a tax on the American consumer.

Beyond basic economics, simply look to history.

McKinley’s Tariff of 1890? Massive economic drag, Republicans lost 90 House seats.

Smoot-Hawley in 1930? Worsened the Great Depression. Ben Stein explained this quite eloquently in Ferris Bueller’s Day Off.

Unfortunately, Trump has always loved tariffs. While he’s flip-flopped on countless issues over the years, his stance on trade has remained remarkably consistent. Back in the 1980s, he even took out a full-page ad in The New York Times railing against free trade. It’s one of the few positions he’s held onto consistently.

In his first term, we got lucky.

The normal Republicans—Mnuchin, Paul Ryan, Mitch McConnell—managed to keep him focused on tax cuts while the markets soared. Tariffs were more bark than bite, largely symbolic. They were also focused on adversaries like China instead of allies like Canada.

But this time around? The guardrails are gone. He’s surrounded by MAGA loyalists and sycophants, and he’s charging ahead with his most unfiltered instincts.

What is an investor to do?

So, here we are. Trump just dropped the biggest tariffs in U.S. history, and now we all have to figure out what to do.

Me? I’m doing nothing.

That’s not laziness. That’s experience and an understanding of history.

If you’re going to be in the market for 30, 40, 50 years, you should expect a few -50% bear markets. That’s the cost of admission. Go back and look at the charts. It’s not just possible—it’s normal.

Massive bear markets happen.

They come out of nowhere when you least expect them.

They never show up when it’s convenient. They come when you're fat and happy and least prepared. And no—you can’t predict them. You can’t call the top, you can’t call the bottom, and if you think you can, you’re kidding yourself. I tried. For years. I gave it up. Eventually, if you’re honest, you will too.

You can catalog the calls from the so-called gurus and permabears. One day they’re right. Most days, they’re wrong. And even when they get the what right, they get the when disastrously wrong.

Bear markets don’t happen in a vacuum. There’s always something real and terrifying going on. That’s what gives them their power.

I remember what it felt like when Lehman went down, when money market funds were about to break the buck, when it felt like the entire global financial system was going to collapse in real time. We were a hair away from a full-blown Depression. I studied the history—I knew the signs. I thought we were toast.

We got lucky.

Similarly, 1987 looked like a redux of 1929. The bear market of the ’70s was accompanied by gas lines, stagflation, and the end of American exceptionalism.

The dot-com crash? That one didn’t feel existential, but it still wiped out 40% of the market.

COVID? Global economy shut down. Planes grounded. Cities silent. Millions dead. We had no idea how we’d get through it.

It’s tempting to think you’re going to be the next Michael Burry. Watch The Big Short one too many times and suddenly you think you’re clairvoyant.

Here’s the thing: every boom looks like a bubble. Every bear market looks like it can get even worse.

Market timing isn’t just hard. It’s a two-part magic trick: you have to nail the top and the bottom.

Japan looked frothy in ’85—but it didn’t crash until ’89. Greenspan called “irrational exuberance” in ’96. The market didn’t really begin declining until 2000.

And the bottom? Never obvious. In March 2009, when the world was hanging by a thread, stocks were barely at historical average valuations. Was a CAPE ratio of 15 really a low for the market when we were facing the prospect of another Depression?

There’s no giant neon sign flashing “Buy here,” just as there’s none saying “Sell here.”

You can look at indicators like the Buffett metric or the Shiller P/E, but even those don't come with clear signals. I thought the Buffett metric—market cap to GDP—looked absurdly overvalued back in 2020. But guess what? The market kept climbing.

Dividend yields used to be a reliable guide—until the 1950s. The reality is, once an indicator becomes widely known, it tends to stop working.

Which brings us back to now: What’s an investor supposed to do?

What to Do?

We’re in an unpredictable environment. Trump just dropped the biggest tariffs in history. Maybe he backs off. Maybe he doesn’t. Maybe he cuts a deal with a few countries, walks it back, and the market rallies. Or maybe he digs in, the courts sit on their hands, the tariffs stick, and we get a 60% drawdown.

Nobody knows.

And that’s exactly the problem.

You might be the kind of investor who can stomach a 50% drawdown. JL Collins, whom I have spoken to on my podcast, is like that.

That’s not me.

I hate volatility. That’s why I used to obsess over timing markets using tools like the yield curve or the CAPE ratio. I wanted a signal. I wanted to know when the next crisis would hit so I could avoid it. I wanted to be Michael Burry or Stanley Druckenmiller or Buffett shutting down his hedge fund in 1969.

Turns out—I’m not.

And odds are, neither are you.

Eventually, I realized I needed a different approach. I went looking for a system that didn’t rely on clairvoyance, and I found it in the work of Harry Browne. His idea was simple: own a mix of assets that do well in different economic environments—stocks, treasuries, gold, and cash. Rebalance regularly. Sleep at night.

That clicked for me.

You don’t have to sacrifice much in return. But you dramatically reduce the gut-punch drawdowns that make investing so psychologically painful. Worried about the dollar collapsing? You’ve got gold. Scared of a deflationary spiral? Treasuries tend to shine. Stocks for growth, cash for optionality.

Even if you’re not paranoid like I am, the data speaks for itself.

These diversified portfolios—Harry Browne’s Permanent Portfolio, Tyler from Portfolio Charts' Golden Butterfly, Frank Vasquez’s Golden Ratio, or the weird portfolio—are designed to survive anything. And they work.

Personally, I use my own variation, which I call the “Weird Portfolio.” But all of these share the same DNA: mix uncorrelated volatile assets, rebalance regularly, stocks, treasuries, gold, and the result is more than the sum of its parts.

Let me show you.

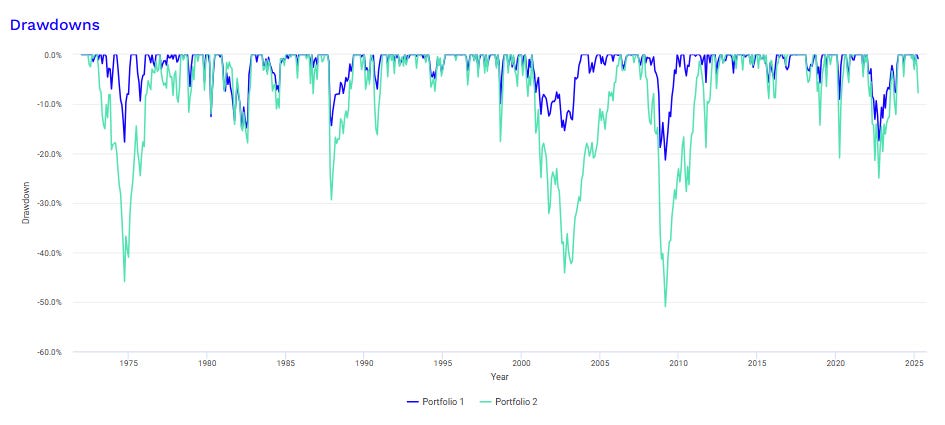

Let’s run a backtest on a simple version going back to 1972:

50% US stocks

20% 10-year treasuries

20% gold

10% cash

Sounds conservative, right? You’d expect lackluster returns. But it earns a 9.6% CAGR, turning $10,000 from 1972 into $1.3 million today. Compare that to a 100% stock portfolio, which earns 10.6%. Only a 1% difference.

Yes, the 1% extra from 100% stocks adds up to more over the long term ($2.1 million in this case), but with the diversified portfolio you get massively more shallow drawdowns.

1973–74 bear market: down 17.7% vs. market down 40%

2008: down 21% vs. market down 50%

COVID: down 9% vs. market down 20%

1987: down 14.4% vs. nearly 30% for the market

This is what makes the portfolio more easy to stick with.

With a lower volatility portfolio, it doesn’t scare you out of the game.

And thanks to something called Shannon’s Demon, the volatility actually works in your favor. When you rebalance volatile, uncorrelated assets, the act of rebalancing creates excess return. Magic? No—math.

Here’s the math:

The weighted average return that you would expect from this portfolio (i.e. 50% times the stock CAGR, 20% from the 10-year treasury CAGR, and so forth) is 8.64%. But because of rebalancing, you actually earn 9.6%. Same thing with drawdowns: the weighted average drawdown is over 42%. In the portfolio? Just 21%.

Standard deviation also drops from 13.5% to 9.2%.

This was a revelation for me. I didn’t have to choose between forecasting or taking gut-wrenching losses every 10–15 years. I could just build a portfolio designed to take punches and keep moving forward.

So if you’re like me—if you hate volatility, hate guessing, and don’t want to be glued to CNBC waiting for what insane thing that Trump says next—consider this kind of portfolio.

There are many flavors. You can go deeper with leverage or add managed futures if you're feeling spicy. But at its core, it’s simple: stocks, bonds, gold, cash. Balanced. Rebalanced. Repeat.

There are tons of variations out there, and with these building blocks, you can create something that works for you. I highly recommend playing around with tools like Portfolio Visualizer and Portfolio Charts—they’re great for testing ideas and seeing what clicks.

And when the President imposes the largest tariffs in history, a war breaks out, markets crash out of nowhere, a different President does something else you find unpalatable, you won’t panic. You’ll shrug, rebalance, and go back to your life.

You can do nothing.

That’s exactly what I’m doing right now—even though I think the Trump tariffs are completely nuts. I’m not making any moves. I’m sticking to the asset allocation plan I originally set.

Bottom line: If you're investing for the long term, you have two choices: either accept the occasional 50% drawdown with a 100% stock portfolio, or opt for a more conservative allocation. Whichever path you choose, commit to it—write it down, test it, understand it, and stick with it.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author does not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author of this website accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this website.

Great work VSG, thank you

Fantastic article - balanced, clear logic and very well argued with excellent evidence. Much food for thought and has certainly got me thinking about my portfolio balance! Thank you so much for writing and sharing this.