Textron (TXT)

Key Statistics

EV/EBIT = 15.9x

ROE = 11.7%

Debt/Equity = 56%

FCF Yield = 4.3%

Dividend Yield = .10%

Market Cap = $14.16 billion

The Company

Textron is a large American company that earns its revenue by producing a wide variety of products, primarily in the aerospace, defense, and industrial sectors. It manufactures aircraft such as helicopters and business jets, defense systems including unmanned vehicles and military support equipment, and a range of specialized vehicles and industrial tools. In addition to building these products, Textron provides parts, maintenance, training, and long-term service contracts. The company also offers financing options to help customers buy its aircraft and helicopters.

Textron’s story began in 1923 when Royal Little founded the Special Yarns Company in Rhode Island. Originally, the business produced synthetic yarns. In 1953, it changed its name to Textron Inc. and over time, it grew into one of the first true conglomerates, operating in multiple unrelated industries. The company pursued a strategy of diversification, acquiring businesses in different sectors to reduce risk and increase market reach. This approach allowed Textron to enter the aerospace, defense, automotive, and industrial markets.

Textron’s growth has been shaped by key acquisitions. One of the most important was its 1960 purchase of Bell Helicopter, a company known for pioneering vertical lift aircraft. In 1992, Textron acquired Cessna, a major producer of small aircraft. Later, in 2014, it bought Beechcraft and combined it with Cessna to form Textron Aviation. Most recently, in 2022, Textron acquired Pipistrel, a European manufacturer of electric aircraft, signaling its commitment to sustainable aviation technologies. These acquisitions have helped transform Textron into a global leader in aviation and industrial products.

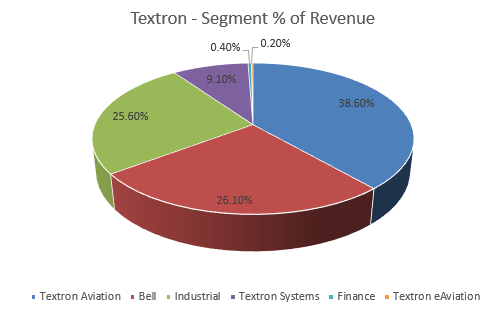

By 2024, Textron had organized its operations into six major business segments: Textron Aviation, Bell, Industrial, Textron Systems, Finance, and eAviation. Textron Aviation is the largest, contributing 38.6% of the company’s revenue. Bell follows with 26.1%, and the Industrial segment makes up 25.6%. Textron Systems provides 9.1%, while Finance and eAviation contribute 0.4% and 0.2% respectively. About three-quarters of Textron’s customers are commercial clients, while the remaining quarter consists of government and military customers, particularly in the United States.

Textron Aviation is the company’s most recognized division, manufacturing and servicing aircraft under the Cessna and Beechcraft brands. It also supports the legacy Hawker business jet line. Over the years, Textron Aviation has delivered more than 250,000 aircraft to customers in more than 170 countries. These aircraft serve various purposes, including flight training, personal and business travel, air ambulance missions, and military surveillance. Some of its best-known planes include the Cessna Skyhawk, a leading trainer aircraft, and the Beechcraft Baron, a twin-engine aircraft favored for short business trips. The King Air turboprop series is widely used for executive travel and government missions, while the Citation series of business jets—such as the M2 Gen2, CJ3+, Latitude, and Longitude—offer fast, comfortable travel options for corporate customers.