Snap-On (SNA)

Key Statistics

EV/EBIT = 10.1x

ROE = 20.4%

FCF Yield = 8.05%

Dividend Yield = 2.79%

Debt/Equity = 30%

Market Cap = $10.87 billion

The Company

Snap-on is a high-end manufacturer of tools, equipment, and diagnostics with a focus on the automotive repair market.

Their brand is known for exceptional quality and durability. The company was founded in 1920 and has grown steadily over the last century, consistently maintaining its reputation among professionals for the quality of its products. As a result, Snap-on products command a pricing premium over other brands.

The business is divided into four areas: Commercial & Industrial Group (equipment for heavy industry and large organizations), the Snap-on Tools Group (mostly automotive focused), the Repair Systems & Information Group (business operations services professional vehicle repair customers - like repair shops & dealerships), and Financial Services, as many of the products are financed by customers.

Tools are 42.13% of revenue, commercial & industrial is 23.8%, repair systems is 26.46%, and financial services is 7.6%.

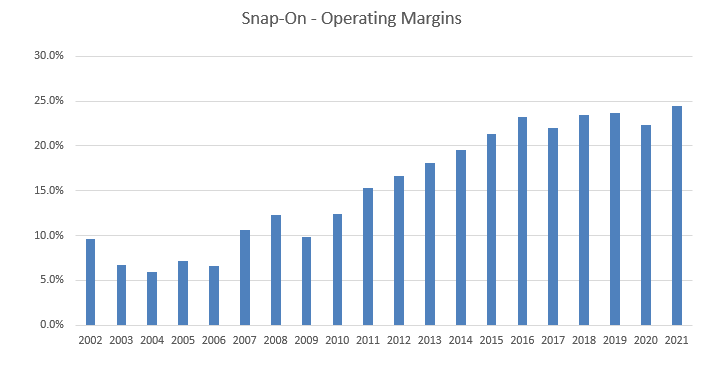

Repair Systems and financial services have grown as a percentage of revenue since 2009. Repair systems have grown from 16.5% of revenue in 2009 to 26.46% in 2021. Financial services have grown from 2.4% to 7.6%. The changing composition of the business has helped improve margins. Operating margin has increased from 9.9% in 2009 to 24.4% in 2021. However, tools remain the bread & butter of the business. They were 41% in 2009 and are 42% today. Revenues have grown by 48% in the tool segment over that period.

Snap-on operates through franchises that utilize distinctive mobile vans. A Snap-on van can arrive at a repair site and be able to provide any equipment or diagnostic systems that the shop might need. Often, these vans will report to a customer (an auto repair shop, for instance) and be able to quickly supply whatever they need.

The instant availability of ordering is important. Often, if a tool is needed for a repair happening today, it needs to be replaced instantly. A repair shop can call up their local Snap-on franchise, and quickly get exactly what they need. Snap-on can also offer them instant financing on the spot.

In other words, Snap-on’s ability to deliver tools and diagnostic devices nearly instantly and their ability to offer instant financing cannot be easily duplicated by a competitor. Professionals need these tools immediately and Snap-on can provide them. The constant communication with the van service also establishes an entrenched relationship that is not easily duplicated.

Performance

Since 2000, the stock has grown at a 12.59%, beating the total stock market’s 7.16% CAGR.

The performance of the company has been matched by consistent growth in sales, free cash flow, and earnings.

On a per share basis, there has been significant growth in FCF/share and EPS/share due to stock buybacks and an improvement in operating profitability from 19.1% in 2012 to 26.7% in 2021.

Moat and Growth Prospects

Snap-on’s moat is derived primarily from its reputation with professionals as a brand that manufactures the best high-end tools that are worth a premium price.

They are not cheap tools that will break under pressure. They’re known for being long-lasting, high quality, and durable. Customers understand this and the reputation has endured for decades.

Unlike standard cheap tools, Snap-on tools are of a much higher quality and will last for years instead of breaking after heavy use. In fact, their hand tools come with a lifetime warranty, which is a good indication of the extraordinary quality of the product.

There is a reason they have been in business for a century.

Additionally, Snap-on has direct relationships with customers via their franchises and mobile van system. They have established relationships with their clients. As mentioned before, this is a critical component of the moat that should shield them from disruption.

In terms of growth prospects, Snap-on should grow revenues with nominal GDP.

Additionally, this is a global company, and that global reach is expanding. They are focused on expanding their presence in emerging markets, which ought to be a source of future growth.

Financial Quality

Snap-on has a high degree of financial quality. Debt/equity is low at 30%. The Altman Z-Score is 5.33, so there is zero bankruptcy risk. The Beneish M-Score is -2.49, so there is no evidence of any financial manipulation. Interest coverage is robust at 26.5, so the company would have no trouble meeting any of its obligations. ROIC has averaged 14.5% for the last decade and WACC is estimated at 6.8%, so they are not a net destroyer of capital.

Valuation

From a yield perspective, the current free cash flow yield is 8.05%, which is exceptionally high for a company with a moat that has been able to reliably grow and withstand recessions. The dividend yield is 2.79% and they have been a consistent dividend grower throughout their history. Share count is down 1.24% in the last year. They began buying back stock consistently in 2016.

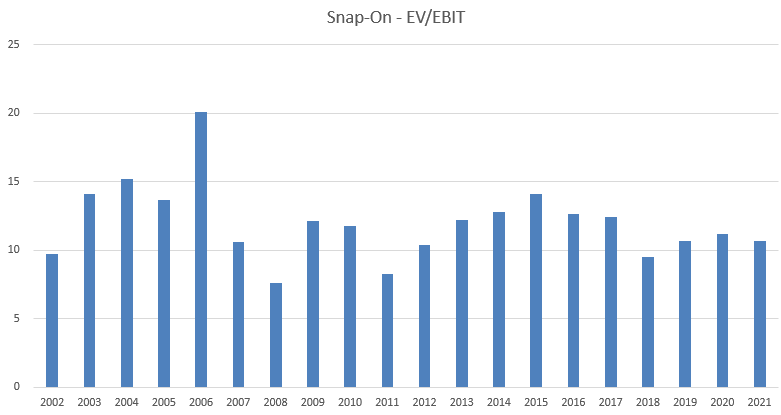

Snap-on has never truly had a stretched valuation. In the last 20 years, the highest EV/EBIT it ever had was in 2006 when it was 20x. At the end of 2008, it dipped to 8x. At 10.1x currently, it is at the lower end of that range.

Price/sales is more problematic. In the 2000’s, Snap-On traded at a low price/sales multiple typically below sales. The average price/sales multiple was .96x in the 2000’s. In the last decade, the price/sales multiple has averaged 2.28x. Currently, the stock trades at 2.5x.

On the surface, this looks problematic, but I think this is easily explained by the improved profitability of the business over this time period.

Profitability has increased from sub-10% in the 2000s to consistently above 20%. That justifies a much higher price/sales multiple.

Checklist

Can the stock deliver a 10% CAGR for the next decade?

I think that the stock can deliver a 10% CAGR over the next decade. Historically, revenues have grown with nominal GDP of around 5%. It’s possible that they grow faster than that with their expansion into emerging markets. EPS and FCF/share grow much more quickly thanks to share buybacks. The current shareholder yield is 4.03%, and that is likely to grow in the future. The multiple is currently on the low end, so I wouldn’t expect much compression unless faced with a significant recession. I think that the company deserves a much higher multiple.

Pass.

Has the company generated consistent returns for shareholders?

Yes, the company has generated consistent returns for shareholders. They have grown steadily since 1920 and have not destroyed shareholder capital. Since 2000, the stock has delivered a 12.59% CAGR.

Pass.

Has the company survived previous recessions?

The company has been around since 1920 and has survived every recession faced in that period, including the Great Depression. During the financial crisis, EPS dipped from $4.12 in ‘08 to $2.33 in ‘09. By 2011, they already surpassed the previous cycle’s peak to $4.75 per share. They did not record an operating loss for the entire period of the global financial crisis.

Pass.

Does the company have a moat?

They do have a moat, derived from their strong reputation among professionals. They also have entrenched relationships with their customers and have the ability to deliver products & financing the same day.

Pass.

Does return on equity exceed 10% without the use of heavy leverage?

Snap-on has averaged a 20.1% return on equity for the last decade with minimal use of debt.

Pass.

Is the company financially healthy?

Snap-on is free cash flow generative and has minimal debt. Debt/equity is only 30% and interest coverage is healthy. They score highly on all measures of financial health.

Pass.

Is the industry in secular decline?

The tools business is not in secular decline. EV’s represent a threat, but the business itself is not in secular decline. In fact, EV’s might present an opportunity for new tools and diagnostic systems to be developed.

Pass.

Is management sketchy?

Management is not sketchy. They have not demonstrated any behavior that runs counter to the interests of shareholders. The current CEO, Nicholas Pinchuk, has done an exceptional job of being a strong steward of capital, Snap-On’s balance sheet, and overseeing a strong improvement in profitability.

Pass.

Would I be comfortable if I couldn’t sell the stock for 10 years?

I would be comfortable if I was forced to own this stock for a decade. I can reasonably conclude that it will exceed by 10% CAGR threshold and I think it could withstand whatever recession pops up over the next 10 years. It’s likely to survive over the next decade. The stock isn’t particularly expensive so multiple compression from a high valuation is a low risk.

Pass.

Is the stock cheap on an absolute and relative basis?

The stock is cheap on the basis of free cash and shareholder yields. The EV/EBIT multiple is on the low end of where the company has traded historically. Price/sales is on the higher end, but I believe this is due to the improving profitability of the company.

Pass.

Why It’s Cheap

Cheap reason #1: Electric vehicles

The concern is that electric vehicles will not require as much maintenance as traditional vehicles, which will eat in Snap-on’s business. Currently, electric vehicles are 5% of auto sales. The Biden administration set a goal that this will reach 50% by 2030.

I think the 50% goal is ambitious and unlikely to happen that quickly.

With that said, there isn’t a doubt that EV’s will expand. Even if it reaches the 50% figure, bear in mind that’s 50% of *new* sales. Even if we reach 50%, there will still be a sizable fleet of gas-powered vehicles. The average age of a car on the road is 12 years. That number is expanding because modern cars last a long time. In 2030, a majority of the cars on the road will still be gas-powered.

Also, electric vehicles are still going to break down and need repairs. It’s a mechanical system with a lot of moving parts. Moving parts break and need to be repaired whether the power source is electric or internal combustion.

It’s not as if the auto repair business disappears when we buy more EV’s. In fact, EV’s are going to need even more specialized diagnostic equipment and brand new tools to fix.

Snap-on is developing these tools and diagnostic equipment. This could even be an opportunity for them in the future.

Cheap reason #2: The company is over-earning.

Snap-on experienced massive growth in the last year thanks to supply chain problems and a booming economy. EPS increased from $11.55/share to $15.22/share from 2020 to 2021.

Due to the supply chain disruptions, used cars are expensive and new cars are hard to come by. As a result, people are spending more money repairing their old vehicles.

In terms of the economic cycle, the company managed to survive the Great Recession without having any losses. Snap-on had no losses and generated consistent FCF during that period.

Additionally, it only took two years for Snap-on to begin posting record results again. EPS fell from $4.12 in 2008 to $2.33 in 2009. By 2011, they earned $4.75/share.

Cheap reason #3: The financing business is risky.

Snap-on offers financing to their customers. While Snap-on itself is conservatively financed, they are still dependent on their customers to make their payments on the tools & systems that they purchased. Snap-on originated $1.073 billion in financing in 2021 with an average yield on finance receivables of 17.7%. The average yield on the contract receivables is 8.5%.

The financing business is also nothing new to Snap-On. It hasn’t grown at an unsustainable pace with the business. In 2007, loan origination was $539.6 million. Total company revenues were $2.8 billion. In 2021, loan originations were $1.073 billion and total company revenues were $4.6 billion. The loan business doubled and the overall business grew by 64%. It doesn’t seem like the loans are advancing at a pace that is radically out of line with the growth in the total business.

Additionally, the financial services division remained profitable through the financial crisis. Snap-on’s clients weren’t going bankrupt during the financial crisis. People still needed their cars fixed during the recession. I suspect they’ll still need their cars fixed during the next one, too.

Conclusion: I think that Snap-On is a wonderful company and it trades at a wonderful price. I am long.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this website.