Qualitative vs. Quantitative Value Investing

Two seemingly conflicting camps have long held sway in value investing: quantitative and qualitative. This article explores the relationship between these two approaches and how I combine them to form my approach.

I’ve taken concepts from both schools of thought to create my own approach.

The Quantitative Argument

Quantitative factors play a pivotal role in my investment approach. I kickstart my articles with critical quantitative statistics about each stock that I am considering.

My experiences and the data have taught me the vital importance of considering enterprise multiples, debt levels, and financial quality metrics such as the M-Score and interest coverage. These quantitative guidelines serve as essential guardrails, helping to steer clear of trouble.

Enterprise multiples offer valuable insights into a company's valuation, considering its debt and cash levels and market capitalization relative to its owner earnings.

Debt levels are crucial in assessing financial stability and resilience, especially during economic downturns. Metrics like the M-Score and interest coverage ratio help in identifying potential accounting irregularities or financial distress, respectively.

The data confirms this. Low enterprise multiple stocks outperform. Stocks with high financial quality metrics have less severe drawdowns.

If you inverted this and bought stocks with high enterprise multiples, poor interest coverage, poor M-Scores, and high levels of debt, then the portfolio would have poor returns and deep drawdowns.

In numerous studies and practical applications, quantitative screens and models have consistently demonstrated superiority over more active approaches involving human judgment.

A prime illustration of this is Vanguard's Small Cap Value index fund, which has outperformed many active value investors along with the overall market.

Value stock screens, which incorporate factors such as low valuation multiples and financial quality criteria, often outperform even the most skilled individual investors over the long haul.

An example of this are the stock screens at AAII. One could peruse the stock screen performance at AAII and come to a similar conclusion. A Ben Graham stock screen, looking for low multiples and low debt levels, boasts a 19.2% CAGR. Similarly, a simple screen involving low price to free cash flow stocks has a CAGR of 16.5%.

These top-tier investing results would result in legendary track records for a manager.

Moreover, empirical evidence highlights the near uselessness of expert human judgment, even when armed with extensive data.

This is best conveyed through the work of Phil Tetlock. Phil Tetlock's research into forecasting results across various disciplines emphasizes the limitations of human judgment, even among experts armed with high quality data. He studied the performance of forecasters from many different disciplines and concluded that they are usually more inaccurate than simple rules-based models.

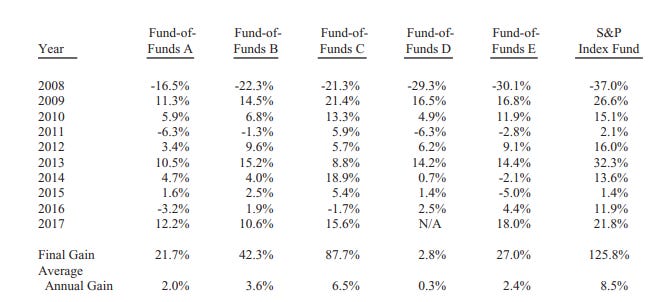

Another example is the Buffett bet from 2007-17. A hand picked group of hedge funds under performed miserably during this period.

These hedge funds are not incompetent. They are composed of some of the smartest investment analysts and portfolio managers around. Meanwhile, their average return didn’t only underperform the market, but it delivered an absolutely miserable average annual return of 2.96% after fees. In 2007, a 10-year treasury bond could have been purchased at 4%.

All of this information underscores the value of a disciplined, quantitative approach that relies on data rather than subjective human judgment.

The Qualitative Argument

Qualitative analysis, in contrast, uses subjective human judgment to evaluate and forecast a company's prospects, competitive advantages, and sustainability, which are crucial for determining whether a business can survive and earn excess returns for an extended period, such as 10 years.

Pure quants would argue this is impossible and a waste of time.

I disagree.

I believe that qualitative insights are crucial. I also believe that humans can provide useful qualitative insights about business quality.

I use these insights to define an investable universe.

Operating within a universe of high quality companies that I know can survive and thrive over the long run is helpful from a behavioral perspective.

Holding quality businesses that I understand is something that I can stick with.

Warren Buffett, a staunch advocate of qualitative value investing, famously emphasized that value investing transcends buying stocks based on low multiples, eschewing the pure quantitative approach. He argued that qualitative projections for growth and business quality are an integral aspect of a stock's intrinsic value.

Buffett argues that there is a symbiotic relationship between quantitative and qualitative factors in the investment process.

This was best outlined in his 1992 letter:

Indeed, as Buffett points out, an assessment of a company’s quality and growth prospects are critical to calculating an accurate valuation. Projecting this is very hazy and prone to human misjudgment, but it’s a critical aspect of the process.

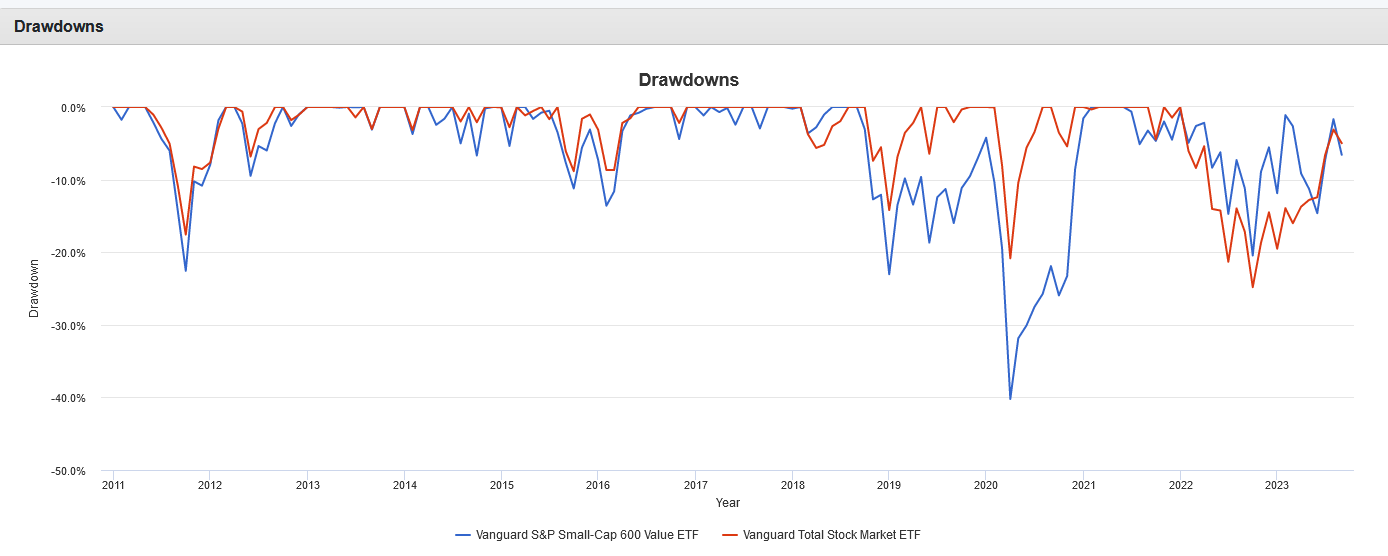

Qualitative insights can be also be particularly invaluable during market crises, as they provide the confidence to hold positions through tumultuous times. The COVID-19 pandemic serves as a stark example. During this crisis, identifying and investing in high-quality businesses was pivotal in minimizing the drawdown. Pure small cap value, in contrast, witnessed a much more severe drawdown than the broad market.

Qualitative analysis can guide an investor to select businesses that exhibit enduring resilience, helping investors navigate economic uncertainties and volatile market conditions.

The focus on business quality sets aside the pure quantitative notion that all companies are akin to toasters and will inevitably revert to the mean. Instead, it acknowledges there are genuinely high-quality businesses which have enduring competitive advantages that allow them to earn excess returns over time.

Plain observation reveals the existence of discernible disparities in business quality. Consider, for instance, the stark contrast between a company like PepsiCo and one entrenched in the cyclical world of gold mining or airlines. The divergence in their quality is palpable and the superior quality of PepsiCo is an attribute that can be easily discerned.

In contrast, a purely quantitative value investor would say that no such difference can truly be discerned by human judgment.

The Best of Both Worlds

My qualitative work focuses on defining an investable universe of high-quality companies that earn returns on capital which exceed their cost of capital over the long run. Qualitative analysis allows me to identify businesses with enduring qualities and competitive advantages.

I believe that I have identified many of these businesses on this website.

Meanwhile, my quantitative value criteria establish solid guidelines for buying and selling. They also create rules that avoid companies in distress. This quantitative foundation ensures investments are made based on data-driven valuation assessments, financial stability, and other quantitative metrics.

The synergy between quantitative and qualitative elements becomes most important when considering the investment time horizon.

While quantitative criteria help identify currently undervalued stocks with solid financials, qualitative insights are essential for finding companies that can survive market fluctuations and rough economic conditions. This is essential. After all, any multi-year period is going to have a number of deep drawdowns and challenging economic circumstances. One doesn’t want to be stuck in a highly cyclical business during a severe recession, for instance.

The ability to differentiate between high-quality businesses and their counterparts adds a layer of confidence to my decision-making process.

In value investing, the marriage of quantitative and qualitative approaches offers a balanced strategy. By embracing both disciplines, I apply the benefits of data-driven decision-making while ensuring that my portfolio includes high-quality, enduring businesses that can be held with confidence. This combined approach helps mitigate risks and enhances long-term performance.

Most importantly, it helps me behaviorally. I can hold a high quality business through an economic disaster. I can look at a company like Alphabet and know they will survive another 2007-09 financial crisis.

The marriage of quantitative and qualitative value investing represents a comprehensive investment strategy that acknowledges both methods' strengths and limitations.

“Adapt what is useful, reject what is useless, and add what is specifically your own.” - Bruce Lee

If you are interested in learning more about both approaches, I recommend the below books:

Quantative Value Investing

Quantitative Value https://www.amazon.com/Quantitative-Value-Practitioners-Intelligent-Eliminating-ebook/dp/B00B1FK0AS/

What Works on Wall Street https://www.amazon.com/What-Works-Wall-Street-Fourth-ebook/dp/B005NASI8S

Deep Value https://www.amazon.com/Deep-Value-Investors-Contrarians-Corporations/dp/1118747968/

Superforecasting https://www.amazon.com/Superforecasting-audiobook/dp/B0131HGPQQ

Qualitative Value Investing

The Buffett Letters. The greatest investor in history taught an investing class to the world for nearly 50 years and gave it away for free! https://www.berkshirehathaway.com/letters/letters.html

The Little Book that Builds Wealth https://www.amazon.com/Little-Book-That-Builds-Wealth/dp/B001D48VKI/

Buffettology https://www.amazon.com/Buffettology-Previously-Unexplained-Techniques-Investor-ebook/dp/B00367KILK/

The Warren Buffett Way https://www.amazon.com/Warren-Buffett-Way-Robert-Hagstrom-ebook/dp/B00FAMMZN8/

Beating the Street https://www.amazon.com/Beating-Street-Peter-Lynch-ebook/dp/B00768D664

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this website.

Re illustration at the top of the article: Could I be the only subscriber with an HP 12C always near my computer keyboard?