Nucor (NUE)

Key Statistics

EV/EBIT = 7.5x

ROE = 22.92%

Debt/Equity = 33%

FCF Yield = 11%

Dividend Yield = 1.14%

Market Capitalization = $47.25 billion

The Company

Nucor Corporation is a steel manufacturer. Established in 1958, they pioneered the use of electric arc furnaces (EAF) to produce steel and steel products.

Nucor's products cater primarily to nonresidential construction, durable goods, and capital spending sectors, all of which are deeply intertwined with macroeconomic conditions. As a leading supplier in structural steel and steel joists, Nucor plays a vital role in shaping various industries.

What sets Nucor apart from traditional steelmakers is its utilization of electric arc furnaces (EAFs). Unlike the rigid and energy-intensive blast oxygen furnaces (BOFs) used in conventional methods, EAFs offer more flexibility and efficiency. By melting recycled scrap steel using electric arcs, Nucor significantly reduces energy consumption and production costs, enabling swift adjustments in production to meet fluctuating market demands.

In recent years, the steel industry has witnessed unprecedented growth, driven by surging steel prices amidst a stimulus-driven economic expansion.

This reached its peak in 2022, followed by a moderation in steel prices that impacted Nucor's earnings, which peaked at $28.79/share in 2022. While they have declined from there, the company's earnings per share have remained elevated.

In the past year, they have earned $19.77 per share. This is still substantially higher than the average EPS of $2.85/share between 2011 and 2020.

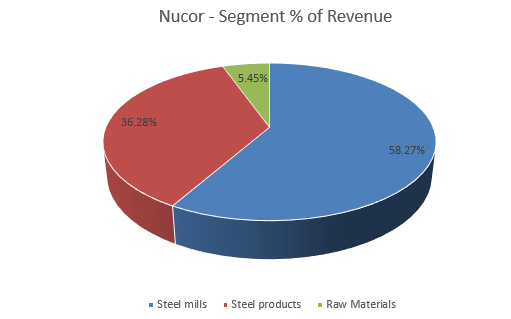

The company operates across three main segments: steel mills, steel products, and raw materials. Of these, steel mills form the largest segment, accounting for the majority of Nucor's sales.