Moody's (MCO)

Key Statistics

EV/EBIT = 30x

ROE = 57.9%

Debt/Equity = 193%

FCF Yield = 2.7%

Dividend Yield = .80%

Market Cap = $84.51 billion

The Company

Moody’s Corporation (NYSE: MCO) is one of the most important financial services companies in the world, known primarily for its role in assessing credit risk.

In simple terms, Moody’s helps investors understand how risky it is to lend money to different borrowers—whether they’re corporations, governments, or financial institutions. Moody’s earns most of its revenue by charging fees to those borrowers in exchange for providing these credit ratings. These ratings are like report cards that show how likely a borrower is to repay their debts, which in turn helps investors decide where to put their money.

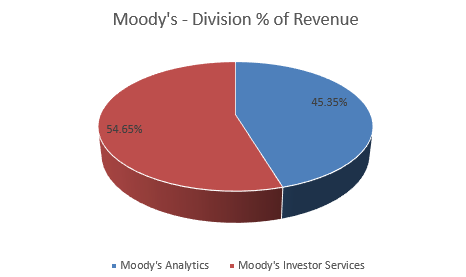

But Moody’s business is not limited to credit ratings. It also earns revenue through a fast-growing division called Moody’s Analytics, which provides tools, software, and data to help organizations manage financial risk, make smarter business decisions, and comply with regulations. Together, these two divisions serve as a one-two punch: Moody’s Investors Service (MIS) gives an outside opinion on risk, while Moody’s Analytics (MA) equips clients with the resources to understand and manage that risk themselves.

Geographically, Moody’s is a global company, but a significant portion of its earnings still comes from the United States. Around 54% of Moody’s total revenue is generated within the U.S., showing the company's strong presence in one of the world’s largest and most active financial markets. Importantly, 62% of Moody’s revenue is recurring, meaning customers continue to pay over time for long-term services. This type of steady income is highly valued because it provides stability and predictability in a constantly changing financial world.

Moody’s history stretches back more than a century. The company’s roots were planted in 1909, when founder John Moody published a manual analyzing the finances of American railroad companies. At the time, railroads were the backbone of the economy, and investors needed reliable information to guide their decisions. Moody’s guide stood out because it took complex financial data and explained it in a way that everyday investors could understand. This breakthrough led to the launch of Moody’s Investors Service in 1914, which would grow into one of the most powerful and trusted names in finance.

Throughout the 20th century, Moody’s expanded far beyond the railroad industry. It began rating the creditworthiness of companies, governments, and even complex financial products like asset-backed securities. As global financial markets evolved and became more sophisticated, the need for trustworthy credit ratings became even more critical. A Moody’s rating became almost essential for any company or country looking to raise money in the debt markets, giving the agency tremendous influence.

A major turning point came in the year 2000, when Moody’s was spun off from its former parent company, Dun & Bradstreet. This allowed Moody’s to operate as an independent, publicly traded company focused solely on credit ratings and financial analytics. On September 30, 2000, Moody’s Corporation officially began trading on the New York Stock Exchange under the symbol “MCO.” Since that time, it has continued to expand globally and remains a staple holding for many large institutional investors.

Today, Moody’s operates two primary business divisions: Moody’s Investors Service (MIS) and Moody’s Analytics (MA).

Moody’s Analytics accounts for about 45% of Moody’s total revenue. MA provides advanced tools and insights that help businesses, banks, insurers, and governments manage risk and make better decisions. Its products include economic forecasts, financial data platforms, risk modeling tools, and compliance software. In 2024, MA served more than 14,800 customers in 165 countries and generated $3.3 billion in revenue.

Moody’s Analytics is divided into three main segments:

Decision Solutions (DS) – This group offers cloud-based tools that help financial institutions assess credit risk, comply with regulatory requirements, and streamline internal processes. These tools are used by banks, insurance firms, and corporations to make smarter, faster decisions.

Research & Insights (R&I) – This segment provides economic data, market forecasts, and credit research. It helps customers understand trends and anticipate shifts in the economy, interest rates, and credit conditions.

Data & Information (D&I) – This team supplies rich, structured data on companies, credit performance, and other financial indicators. These datasets support everything from financial modeling and due diligence to stress testing and regulatory reporting.