MarketAxess (MKTX)

Key Statistics

EV/EBIT = 25x

ROE = 21.74%

Debt/Equity = 7%

FCF Yield = 4.29%

Dividend Yield = 1.36%

Market Capitalization = $8.27 billion

The Company

MarketAxess (MKTX) is as a leading financial technology firm, with a core focus on electronic trading of bond products.

Traditionally, bond markets heavily relied on verbal negotiations conducted over the phone. However, over the past two decades, there has been a significant shift towards electronic trading platforms, with MarketAxess being one of the key players.

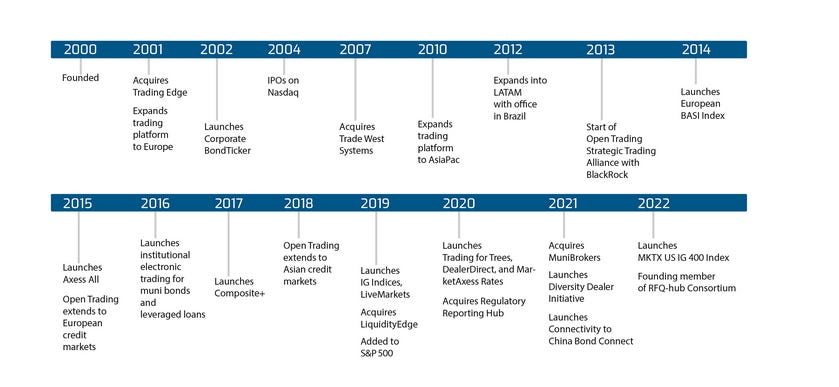

Established in 2000 by Richard McVey, who continues to spearhead the company, MarketAxess operates an advanced electronic trading platform. This platform serves as a tool for streamlining bond transactions, catering primarily to large investors and corporations.

Essentially, MarketAxess revolutionizes the bond trading process for major investors, eliminating the complexities associated with traditional transactions.

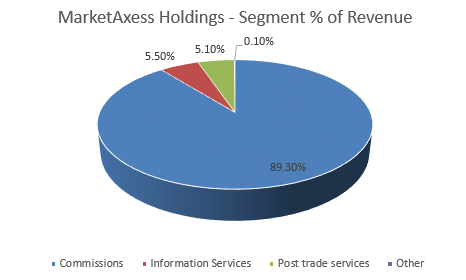

MarketAxess offers electronic trading platforms designed to optimize efficiency, enhance liquidity, and deliver cost savings across global fixed-income markets. Through tools such as the Open Trading marketplace, MarketAxess effectively connects a large network of institutional traders and corporations, offering automated trading solutions and post-trade services to further augment the trading experience.

With a clientele encompassing over 2,000 institutional investors and broker-dealers, MarketAxess facilitates trading in diverse fixed-income securities, ranging from U.S. high-grade bonds to emerging market debt and municipal bonds.

MarketAxess provides a complete trading solution for investors, aiming to meet the different needs of traders at every step of trading. They offer different ways to trade, like disclosed Request for Quote (RFQ) and Open Trading, to help buyers and sellers find each other easily and make deals smoothly. They also have automated trading options that make the process even easier, improving the overall trading experience for clients.

MarketAxess provides traders with many data products to help them make better decisions. These products include pricing algorithms and access to real-time trade data, giving traders the tools they need to understand the market better. Plus, MarketAxess offers index solutions that work well for passive investment strategies, helping investors manage their portfolios better.

Moreover, MarketAxess doesn't just help with trading - they also provide important post-trade services like trade matching and regulatory reporting. Managing the post-trade process well encourages customers to keep trading on their platforms. These services make sure transactions go smoothly and follow financial rules, giving clients confidence in their trading activities.

Data security is a top priority for MarketAxess. Customers need to trust that their information is safe since they share highly sensitive data on the platforms. By showcasing their expertise in this field, MarketAxess can reassure customers, making them less inclined to explore other platforms.