lululemon athletica (LULU)

Key Statistics

EV/EBIT = 25x

ROE = 31.52%

Debt/Equity = 34%

FCF Yield = 1.2%

Dividend Yield = 0%

Market Cap = $48.87 billion

The Company

Lululemon (LULU) is a company that sells workout clothes, shoes, and accessories. They make clothes for athletic activities like yoga and running.

Founded in 1998 by Chip Wilson in Vancouver, Canada, Lululemon initially focused on creating and selling specialized workout clothing, footwear, and accessories. One of their most notable contributions to the fitness fashion scene was the invention of yoga pants in the late 1990s.

The company competes with other major players in the athletic wear market, such as Nike and Under Armour.

Lulu's success stems from its commitment to innovation, using high-quality materials, and maintaining an open dialogue with its customers, referred to as "guests."

At the heart of Lulu's success is its dedication to crafting top-notch workout apparel. They started with their original fabric, Luon, which incorporated a significant amount of nylon microfiber. Over the years, they have refined their materials, introducing innovations such as increased compression, moisture-wicking capabilities, and odor-reducing properties.

Their product line includes iconic items like yoga pants, shorts, sweaters, jackets, underwear, and various accessories like hairbands, yoga mats, and water bottles.

Lululemon has become synonymous with the "athleisure" trend, which represents gym wear that is comfortable and versatile enough to be worn beyond the gym setting. This trend has gained momentum over the years and accelerated during the COVID-19 pandemic as remote work arrangements led to a more casual dressing style.

With a global presence, Lululemon operates stores in several countries, with only 53% of its stores in the United States. Notably, the company has made significant strides in the Chinese market, with 117 of its 655 stores currently located in China.

Lulu's commitment to excellence goes beyond just designing and selling athletic wear. They continuously seek out the best materials and actively engage with customer feedback to enhance their products further. They have also expanded their offerings to include fitness programs and content to cater to their customers' holistic wellness needs.

While historically, most of Lulu's customers have been women, the company increasingly focuses on the male market segment. Today, 35% of their sales are in male apparel, a company segment experiencing growth. Notably, Lululemon has designed products for men that combine the appearance of work-appropriate trousers with the comfort of sweatpants.

Most of Lulu's sales currently come from North America. However, the athleisure trend has caught on globally, and the company aims to extend its reach beyond North America.

Lulu's journey began in 1998 when Chip Wilson recognized the growing number of women participating in sports and the lack of suitable athletic wear for women. The first standalone Lululemon store opened in November 2000, marking the beginning of the brand's ascent. The company gained considerable popularity and momentum, leading to its initial public offering (IPO) in 2007, where it raised $327.6 million by selling 18.2 million shares.

In 2008, Christine Day, a former co-president of Starbucks, assumed the CEO role, overseeing the company's robust growth phase from 2008 to 2013. During this period, Lululemon cemented its brand in North America while venturing into international markets.

However, Lululemon experienced some leadership turbulence in the ensuing years. Founder Chip Wilson stepped down from the company in 2013 and later criticized its direction in 2016, leading to a strained relationship with the company. He also sold substantial portions of his stock in 2019. CEO changes have been another notable aspect of Lulu's history, with Christine Day departing in 2013 and Laurent Potdevin taking the helm until his resignation in 2018 due to misconduct.

The company found stability in leadership under Calvin McDonald in 2018. Under his guidance, Lululemon has focused on expanding its global presence and making strides in the male athleisure apparel market.

In 2019, Lululemon ventured into the fitness technology space by investing in a fitness startup called MIRROR. MIRROR offers an interactive mirror for at-home workouts, providing users with guidance and feedback during exercise routines. The plan was to create new content for this innovative device. In a significant move in 2020, Lululemon acquired MIRROR for $500 million. This strategic acquisition capitalized on the rising trend of virtual workouts at home, which gained popularity during the COVID-19 pandemic.

Much like Peloton exercise bikes, MIRROR became a sought-after yet expensive fitness gadget during the pandemic. It's a $995 device (formerly priced at $1,500) that resembles a large TV.

It's worth noting that a 65-inch smart TV can purchased at around $350.

After the acquisition, MIRROR rebranded as "Lululemon Studio."

The MIRROR device allows users to engage with instructors who guide them through workouts and provide feedback on their form and performance. It also includes access to pre-recorded workout sessions, health-tracking features, and the option to engage personal trainers.

The high cost of this cutting-edge fitness tool and the monthly subscription fee of $39 are of dubious value. Compared to the cost and benefits, joining a gym and hiring a personal trainer is cheaper and more effective.

The surge in MIRROR's popularity during the pandemic can be attributed to the unique circumstances of lockdowns and restricted access to gyms—a $1,500 device with a $39/month subscription for workout guidance made during lockdowns. Subsequently, Lululemon had to account for a substantial $442.7 million expense related to the MIRROR acquisition in 2022.

Performance

Since Lulu went public in 2007, their stock has seen remarkable growth, achieving a CAGR of 19.41%. To put this into perspective, if you had invested $10,000 back then, it would have grown to $160,971.

Their overall business growth has been equally impressive. In just over a decade, they have substantially increased their revenue from a modest $270 million in 2008 to a staggering $8.8 billion in the most recent year.

What's even more impressive are the per-share metrics. Their EPS has skyrocketed from a mere 23 cents to an impressive $7.52 in 2022. Similarly, their FCF/share has seen remarkable growth, going from just 5 cents to a substantial $7.63 in 2022.

This remarkable growth can be attributed to two key factors: improved same-store sales and the expansion of their e-commerce business.

However, it's worth noting that while Lulu has achieved substantial growth, their profitability has dipped slightly from its peak operating margin of 28.7% in 2012 to the current level of 21%.

Moat and Growth Prospects

The financial statements seem to indicate that Lulu possesses an economic moat.

The figures in the financial statements piqued my interest and led me to research and write about the company.

Over the past decade, Lulu has experienced remarkable growth, while consistently achieving an impressive average return on invested capital of 26.5%. Those kind of numbers are usually indicative of an economic moat.

As a prominent player in the athleisure industry, Lulu has gained recognition for its exceptionally high-quality products and meticulous materials sourcing. Their tight control over the sales process, primarily through their stores and online platforms, has enabled them to maintain product quality and gain deep insights into customer preferences.

Lulu also seems to have further growth potential. E-commerce will likely grow and allow Lulu to experience even higher margins. Moreover, they can expand further into international markets, potentially experiencing even more significant growth.

The current strength of their pricing strategy stems from the perception of their products as exceptional quality.

However, let’s take a step back and consider what this business is. It is the business of extremely expensive athletic apparel. Lulu men's trousers are priced at $128, while their yoga pants range from $98 to $118, with their most expensive women's running yoga pants commanding a hefty $168. These elevated prices contribute significantly to their robust operating margins and strong returns on invested capital.

In other words, we are discussing yoga pants that cost well over $100. While they are probably superior to the $20 alternatives available at Target or on Amazon, we’re still talking about yoga pants. In the men's segment, are $128 trousers compelling compared to a pair of Docker's for $50 or Amazon-branded dress pants for $30?

The question arises: How long can Lulu sustain such premium prices?

Will they be able to juggle the challenging task of making customers think that paying over $100 for a pair of yoga pants is a worthwhile use of funds?

Lulu's success heavily relies on its image as a high-end premium brand. It remains to be seen how sustainable this perception is. Premium brands predominantly depend on the 'status' associated with their name, as individuals seek to show off these products to others.

Luxury consumers want to show off the shine and craftsmanship of a Rolex watch, even though a $12 plastic F-91W Casio tells time more accurately. They want to show off the high quality leather of a Hermes purse, even though a non-branded purse from Wal-Mart can hold the same items just as well.

It's unclear if an expensive pair of yoga pants carries the same prestige as a luxury-branded purse or watch.

Additionally, the history of the apparel industry is rife with examples of expensive brands that eventually lost their appeal, especially when it comes to everyday clothing items.

In the 1980s, Jordache jeans were considered luxury items due to an aggressive marketing campaign, but consumers eventually realized they were just overpriced jeans at no higher level of quality than Levi’s, Wrangler, or Lee. Ocean Pacific was another prominent expensive 1980s clothing brand that has largely disappeared into obscurity.

Under Armour, once a wildly popular and highly valued athleisure brand in the early 2010s, has seen its stock plummet by 86% since 2015. Investors used to discuss Under Armour in much the same way they discuss Lulu today.

Trends in the apparel industry are challenging to assess. Keeping up with them and maintaining this position requires exceptional management. Presently, Lulu has good management, but will that last? I’m not certain. After all, their management has experienced exceptional turnover in the past.

For investors, the pressing question is whether the perceived luxury quality of Lululemon products will endure – in other words, whether consumers will continue to pay up $100 for yoga pants. This is not a prediction I am comfortable making; thus, I think the company does not possess a lasting economic moat.

Financial Quality

Lulu currently demonstrates a remarkable financial strength. Their debt-to-equity ratio stands at a low 34%. Additionally, their Altman Z-Score is an impressive 15.73, reflecting an exceptionally low risk of bankruptcy. The Beneish M-Score further underscores their integrity with a score of -3.01, indicating no signs of earnings manipulation.

Furthermore, Lulu has consistently generated positive and expanding free cash flow over the past 17 years. Their ROIC has averaged an impressive 25.3% over the last ten years. Notably, their weighted average cost of capital (WACC) is estimated at a modest 7.7%. With the large gap between ROIC and WACC, that they are not eroding shareholder value.

Valuation

Lulu's doesn’t offer much shareholder yield. They do not currently pay a dividend and their share count has decreased by a modest 0.88% over the past year. Historically, they have not engaged in significant stock buybacks either, with the total share count only decreasing by 12% over the last decade.

The current free cash flow yield is quite meager at 1.2%, particularly when compared to the 10-year treasury yield of 4.2%.

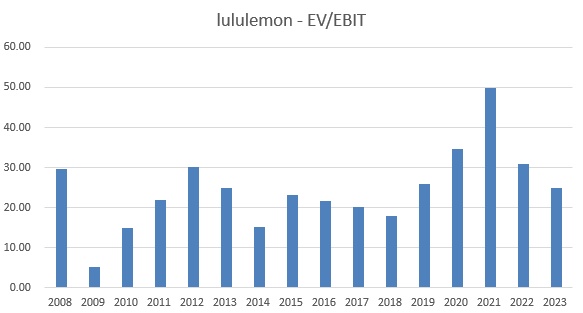

In terms of valuation metrics, the EV/EBIT multiple, though high in absolute terms at 25x, is in line with historical averages for the stock. Since 2008, the average EV/EBIT multiple has been 24x, ranging from a low of 5x in 2009 to a high of 50x in 2021.

When assessing the price/sales ratio, the current level of 5.6x closely aligns with historical averages. Over the last decade, the average price/sales ratio has been 5.5x, with a low of 0.97x in 2009 and a remarkable high of 10x in 2021.

Overall, Lulu's stock appears to be fairly valued relative to its historical trends but is expensive in absolute terms.

I don’t believe that the historical comparisons are worthwhile considering that the 2010-20 period was a phase of hyper growth for the company, which is not sustainable over the long term. Early high-growth phases for companies are typically rewarded with rich valuations.

Checklist

Can the stock deliver a 10% CAGR for the next decade?

Lulu's revenues have grown at a19.5% pace over the past decade. However, it's questionable whether this rapid growth can continue, considering that Lulu has transformed from a relatively small brand into an iconic premium name. Such a transformation is a one-time occurrence.

Nonetheless, if Lulu can maintain its status as a prestigious brand, it's plausible that they could achieve a 10% growth rate over the next ten years.

When it comes to shareholder yield, Lulu's stock hasn't delivered much over the past decade. This is understandable as the the company was focused on growing store counts. If growth slows down, Lulu may need to concentrate more on giving back to shareholders through activities like stock buybacks and dividends. Whether the management is inclined to go down this path uncertain, as it would necessitate a significant shift in capital allocation priorities.

Despite being favorable when compared to historical norms, the current stock valuation appears exceptionally high. In the 2010s, Lulu likely commanded a premium valuation due to its rapid growth rates. However, it's unclear if these growth rates can be sustained in the long term.

Given my doubts about the company's competitive edge, the limited shareholder yield, and the likelihood that the rich valuation will eventually normalize, I don't anticipate that the stock will achieve a CAGR exceeding 10% over the next ten years.

Fail.

Has the company generated consistent returns for shareholders?

Since Lulu went public in 2007 the stock has delivered a CAGR of 19.41%. If you had invested $10,000 back then, it would have grown to $160,971 today.

Pass.

Has the company survived previous recessions?

Lulu is a relatively young company, having been founded in 1998. However, it demonstrated remarkable resilience during the financial crisis. Its net income surged from $8 million in 2007 to $31 million in 2008, $39 million in 2009, and $58 million in 2010. It's essential to note that during that period, Lulu was a smaller, niche brand and not the giant it has become today.

While I have reservations about whether people will continue to buy $100 yoga pants during the next economic downturn, it's hard to deny the strength of its historical performance. In this regard, I must acknowledge its success based on this historical track record.

Pass.

Is the industry in secular decline?

Athleisure is not in secular decline. Fashion has been moving towards greater comfort, and there's little reason to anticipate a reversal. Over the past three decades, the corporate world has shifted from formal suits and ties to business casual attire, and now, dress codes are becoming even more relaxed or disappearing entirely. Given these changes, it appears that the athleisure industry is poised for growth.

Pass.

Is the stock cheap on an absolute and relative basis?

Lulu lacks significant shareholder yield, with no dividends and only a slight reduction in share count. Its free cash flow yield at 1.2% is meager compared to the 10-year treasury yield of 4.2%. Valuation metrics, like EV/EBIT and price/sales ratios, are in line with historical averages, but the stock is expensive in absolute terms. Historical comparisons may not hold, given the unsustainable hyper-growth of the 2010-20 period. I don’t believe that the stock is a bargain.

Fail.

Does the company have a moat?

Lululemon's financials suggest it may have an economic advantage, with impressive growth and high returns on invested capital. The company's quality control and e-commerce potential seem promising. However, Lulu's high prices raise questions about long-term sustainability. Premium clothing brands rely on status, and it's uncertain if pricey yoga pants can maintain the same allure as other high-end luxury products. The history of expensive clothing brands losing appeal adds to the uncertainty. Lulu's future depends on its ability to uphold its luxury image and manage industry trends, which remains uncertain, making its economic moat questionable.

Fail.

Does return on equity exceed 10% without the use of heavy leverage?

Over the past ten years, Lulu has consistently delivered a strong return on equity, averaging 29.4%. Throughout most of this period, the company operated without significant financial leverage, and at present, their debt-to-equity ratio remains low at just 34%. Additionally, Lulu's returns on capital have remained consistently robust, averaging an impressive 26.5% over the past decade.

Pass.

Is the moat currently under attack? Is the attack likely to be successful? Are you being paid for this threat?

Lulu operates in the fiercely competitive athleisure market, facing significant pressure from industry giants like Nike and Under Armour, which offer more affordable options. Moreover, niche athleisure brands like Vuori and Fabletics further intensify the competition. The looming risk is that Lulu may lose market share to rivals, and the stock's lofty valuation doesn't adequately compensate investors for this vulnerability.

Fail.

Is the company financially healthy?

Lulu exhibits strong financial health with a low debt-to-equity ratio (34%) and robust Altman Z-Score (15.73), indicating minimal bankruptcy risk. The Beneish M-Score (-3.01) signals no earnings manipulation. Positive, growing free cash flow over 17 years, and a 10-year average ROIC of 25.3%, well above their WACC (7.7%), reflect value preservation for shareholders.

Pass.

Is management sketchy?

Lulu has gone through a tumultuous management history, but the current management appears to be stable and competent. Calvin McDonald has a strong background and previously held leadership roles at Sephora Americas, Sears Canada, and Loblaw Companies Limited. Since becoming CEO in 2018, he has successfully grown the company and turned the menswear segment into a more significant segment. The MIRROR acquisition appears to be a mistake, but his overall track record is strong. In an industry as fiercely competitive as apparel, great management is essential. Right now, Lulu has great management, but I’m not certain if that will persist into the future.

Pass.

Would I be comfortable if I couldn’t sell the stock for 10 years?

I wouldn't feel comfortable investing in Lulu stock for a decade. I'm uncertain about the sustainability of its competitive advantage. Sustaining high-priced athleisure sales demands robust branding and marketing. While it's possible, I wouldn't bet on it. Furthermore, the stock appears overvalued, more suitable for a high-growth company. I doubt Lulu can maintain its historical growth rate. Given these factors, I wouldn't want a long-term stake in the stock.

Fail.

Conclusion:

Lululemon's success heavily relies on its premium pricing strategy, but its sustainability remains uncertain, given the track record of similar brands. The durability of their competitive advantage is in question. While their financials are impressive, there's uncertainty about whether consumers will be willing to pay premium prices in the future.

Moreover, the valuation metrics appear stretched, indicating a richly priced stock.

In summary, Lululemon doesn't seem to possess the qualities of a high-quality company with a strong competitive edge. Consequently, I won't include it in my watchlist and will pass on it as a potential investment.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this website.

Have you looked at Deckers Outdoors? Its quire interesting and has a similar cult like following like lulu