J.B. Hunt Transport Services (JBHT)

Key Statistics

EV/EBIT = 20.7x

ROE = 13.97%

Debt/Equity = 41%

FCF Yield = 4.3%

Dividend Yield = 1.14%

Market Cap = $15.34 billion

The Company

J.B. Hunt Transport Services (JBHT) is one of the leading freight and logistics companies in North America. The company offers a broad suite of services across five key segments: Intermodal, Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), Final Mile Services (FMS), and Truckload (JBT).

It earns revenue through a combination of per-load fees, fuel surcharges, and long-term customer contracts. By leveraging its operational scale, owned assets, and proprietary technology, J.B. Hunt delivers high-efficiency, cost-effective transportation solutions across the U.S., Canada, and Mexico.

At the heart of J.B. Hunt's business is its Intermodal segment. Intermodal shipping blends long-haul rail transport with short-haul trucking to move freight more efficiently and sustainably. J.B. Hunt was among the first truckload carriers to form partnerships with major railroads like BNSF and Norfolk Southern.

Today, Intermodal represents around 49% of the company’s total revenue and contributes 52% of its operating income. The process typically involves a truck picking up a container from a shipper, transporting it to a rail yard, moving it across the country by train, and then completing the journey with a final truck delivery. This model reduces fuel use, emissions, and highway congestion while offering cost savings to shippers.

Founded in 1961 by Johnnie Bryan ("J.B.") Hunt and his wife Johnelle in Stuttgart, Arkansas, the company originally sold rice hulls for poultry litter. After early financial struggles, the Hunts shifted focus to transportation in 1969, purchasing five trucks and seven trailers. They relocated to Northwest Arkansas and laid the groundwork for a logistics powerhouse. In 1983, J.B. Hunt went public, fully transitioning to transportation and rising to become one of the top 80 U.S. trucking firms.

In 1989, J.B. Hunt revolutionized logistics by launching a groundbreaking intermodal partnership with Santa Fe Railway (now BNSF). This innovation marked a turning point for the industry and solidified intermodal as a core part of the company’s future. In 1993, the company added its Dedicated Contract Services segment, offering long-term fleet outsourcing solutions. Even after J.B. Hunt retired in 2004 and passed away in 2006, the company maintained its momentum by investing in technology, sustainability, and service expansion.

Since 2006, J.B. Hunt has focused on innovation and technology-driven growth. Its proprietary J.B. Hunt 360° digital platform allows shippers and carriers to match freight in real time, improving visibility and optimizing routes. These tools have enhanced efficiency across the company’s five operating segments. J.B. Hunt is now a $12 billion enterprise with approximately 12,000 trucks, 145,000 trailers and containers, and a workforce of around 35,000 employees.

As mentioned earlier, the Intermodal (JBI) segment remains the company’s cornerstone. In 2024, JBI generated $5.96 billion in revenue. Through a blend of rail partnerships and company-managed drayage (local trucking), it offers consistent, efficient freight movement. J.B. Hunt owns a large fleet of containers, chassis, and tractors, allowing for better asset control and service quality. Customers are drawn to Intermodal for its cost savings and reliable delivery timelines. As demand for sustainable shipping grows, Intermodal is expected to remain a dominant force.

The Dedicated Contract Services (DCS) segment is J.B. Hunt’s second-largest unit. In 2024, it brought in $3.4 billion—roughly 28% of total revenue—and accounted for 45% of operating income. DCS provides custom transportation solutions for companies that need private fleet services without the overhead of managing them. These long-term contracts, usually 3 to 10 years, are often structured as cost-plus agreements. That means J.B. Hunt is reimbursed for operating costs plus a fixed margin, providing predictable earnings. DCS handles everything from route design to driver management and serves industries such as retail, food, manufacturing, and e-commerce.

The Integrated Capacity Solutions (ICS) segment functions as J.B. Hunt’s freight brokerage arm. In 2024, ICS generated $1.14 billion—about 9% of total revenue. However, it operated at a $56 million loss, reflecting -7% of the company’s overall operating income. ICS uses the J.B. Hunt 360° platform to connect shippers with third-party carriers for truckload, less-than-truckload (LTL), refrigerated, flatbed, and other transport needs. While the digital platform boosts efficiency and freight visibility, the segment has struggled due to soft freight demand, low spot rates, and high competition. Despite the losses, ICS remains a focus for future growth, particularly as digital brokerage platforms evolve.

The Final Mile Services (FMS) segment earned $910 million in revenue in 2024, contributing 8% of total revenue and 7% of operating income. FMS specializes in last-mile delivery and installation of large consumer goods like furniture, appliances, and fitness equipment. It operates through a national network of cross-dock facilities and uses both company assets and third-party contractors. Contracts typically range from 1 to 5 years and include premium services such as white-glove in-home delivery and product setup. With the rise of e-commerce and increased demand for at-home services, FMS offers strong long-term growth potential.

The Truckload (JBT) segment generated $702 million in 2024, about 6% of revenue and 3% of operating income. JBT provides full truckload dry-van services, transporting freight directly between shippers and consignees. It operates with a mix of company-owned trucks and independent contractors, offering flexibility in capacity. One unique feature is the 360box® program, which allows shippers to preload drop trailers for later pickup, improving efficiency and reducing wait times. JBT earns revenue primarily through per-load charges and benefits from variable cost management in changing market conditions.

J.B. Hunt’s performance in recent years has been hampered by a prolonged freight recession, which began in 2022 and has its roots in pandemic-era distortions. During COVID-19, surging demand for consumer goods, widespread supply chain disruptions, and panic-driven inventory buildup led to a historic boom in freight activity. Carriers rapidly expanded capacity, and retailers overstocked to avoid future shortages. But as the pandemic waned and demand normalized, the industry was left with too much capacity and excess inventory—triggering a sharp and sustained downturn.

J.B. Hunt has been navigating this challenging environment over the past three years. Since late 2022, the company has faced sustained declines in shipping volumes across Intermodal, Truckload, and Brokerage, driven by weak industrial output, slowing consumer demand, and aggressive inventory destocking.

Falling spot rates and contract rate resets have compressed margins, while high interest rates have further dampened freight activity and increased operating costs.

Despite these headwinds, the freight recession has triggered industry-wide consolidation, presenting a long-term opportunity for large, well-capitalized carriers like J.B. Hunt. As smaller and financially weaker competitors exit the market, J.B. Hunt is well-positioned to gain share and benefit from operating leverage when freight demand eventually recovers. The current downturn, though painful, may ultimately restore balance between supply and demand—laying the groundwork for a stronger, more sustainable recovery.

Although some recovery began in late 2024—especially in intermodal—margins have remained tight. Inflation has driven up labor and equipment costs, while uncertainty around tariffs and global trade continues to weigh on future demand.

Performance

J.B. Hunt stock delivered a compound annual growth rate (CAGR) of 11.98% from 2005 through the end of 2024, turning a $10,000 investment into $96,088.48. This performance outpaced the S&P 500, which returned 10.3% CAGR over the same period.

The freight and logistics industry are inherently cyclical and more exposed to economic and transportation-specific swings than the broader market, leading to more frequent and severe drawdowns. From 2005 to 2007 alone, J.B. Hunt experienced three separate drawdowns exceeding 20%. During the 2008–09 financial crisis, the stock declined 52%, though that was roughly in line with the broader market.

Two notable corrections occurred in more recent years. In 2015–16, the stock fell over 30% amid a slowdown in industrial production, weakness in intermodal volumes, and broader fears of a potential U.S. industrial recession. Then in 2018–19, another 30% drawdown was triggered by trade tensions with China, a freight recession, and soft trucking spot rates, all of which pressured sentiment and earnings expectations.

From February 2024 to April 2025, J.B. Hunt stock fell 42% amid slowing freight demand, high interest rates, and excess trucking capacity. Weaker earnings, falling spot rates, and cautious guidance pressured investor sentiment, marking one of the most difficult periods for the company since the 2008 financial crisis.

Presently, the stock has recovered a bit and is in a 30% drawdown.

A meaningful portion of J.B. Hunt’s stock performance since 2005 can be attributed to consistent revenue and earnings growth. Revenue expanded from $3.1 billion in 2005 to $12 billion in 2024, reflecting a 7.42% CAGR.

EPS grew largely in line with sales, rising from $1.32 to $5.60, a 7.85% CAGR, while free cash flow per share climbed from $0.79 to $7.87.

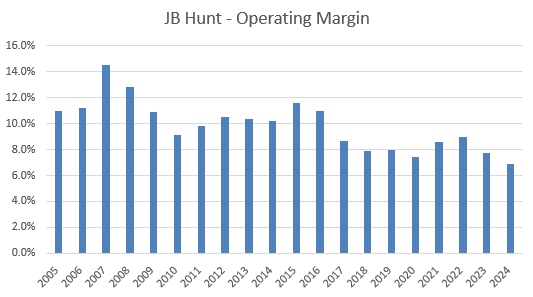

Interestingly, this growth in EPS occurred despite a decline in operating margins, which fell from 11% in 2005 to 6.9% in 2024. In recent years, operating margins have also been under pressure due to the freight recession.

If operating margins have been compressed over time, how has EPS been able to grow largely in line with revenue?

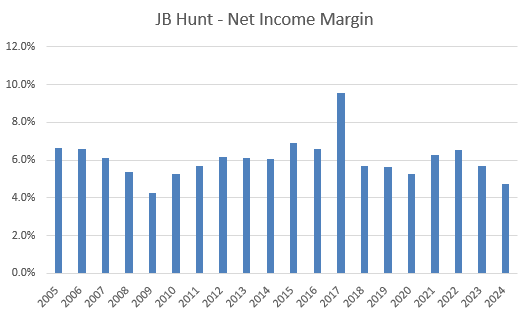

The lower operating margins have been partially offset by a significant reduction in the company’s tax burden.

Taxes as a percentage of operating profit dropped from 36.7% to 22%, with most of the improvement occurring after the 2017 Tax Cuts and Jobs Act. The TCJA lowered the federal corporate tax rate from 35% to 21%, directly benefiting J.B. Hunt’s effective tax rate. The company also benefited from 100% bonus depreciation on qualifying capital expenditures, allowing it to immediately expense large investments in trucks and equipment, further reducing taxable income.

As a result, the decline in net income margin was less dramatic than the drop in operating margins, falling from 6.6% to 4.7% over the full period. Notably, prior to the freight recession that began in 2022, the net income margin was still holding at 6.5%, indicating the underlying strength of the business when macro conditions were more favorable.

While reinvested dividends have modestly boosted returns, dividends themselves have played a relatively minor role. Payouts grew from $0.24 per share in 2005 to $1.72 in 2024, but the dividend yield has typically hovered around 1%, making it a small component of total shareholder return.

A more significant driver has been share repurchases. J.B. Hunt has reduced its total share count by 34% since 2005, consistently and aggressively buying back stock—especially during periods of market weakness—which enhanced earnings per share and supported the stock price.

Another significant factor behind the stock’s performance exceeding underlying revenue and earnings growth has been valuation multiple expansion. The price-to-sales ratio rose from 1.11x in 2005 to 1.42x by the end of 2024, and the price-to-earnings ratio nearly doubled from 16.8x to 30x.

Notably, this increase is primarily driven by a decline in both revenue and earnings—EPS fell from $9.31 in 2022 to $5.60 in 2024—amid the ongoing freight recession. As a result, the stock may appear expensive based on current multiples, but this could be misleading, as suppressed earnings are inflating the valuation metrics.

Moat and Growth Prospects