Genuine Parts (GPC)

Key Statistics

EV/EBIT = 20x

ROE = 19.19%

Debt/Equity = 137%

FCF Yield = 1.9%

Dividend Yield = 3.2%

Market Cap = $17.85 billion

The Company

Genuine Parts Company (GPC) is a global distributor of replacement parts and related services for both the automotive and industrial sectors.

Founded in 1928 in Atlanta, Georgia by Carlyle Fraser, the company began as a small operation with just six employees. Fraser acquired Motor Parts Depot and rebranded it as Genuine Parts Company, with the goal of supplying reliable automotive replacement parts to local garages. The business quickly grew and, in 1936, GPC became the exclusive distributor for NAPA, the National Automotive Parts Association. This partnership helped establish GPC as a trusted name in the U.S. automotive parts industry. By the 1950s, the company had gone public and started expanding its product lines and reach across the country.

Over the years, GPC continued to grow through acquisitions. In 1976, it diversified into the industrial market by purchasing Motion Industries. Then, during the 2000s, the company expanded internationally, acquiring leading parts distributors in Canada, Mexico, Europe, and Australasia.

This international growth transformed GPC into a truly global enterprise, and the company is now recognized for its consistent performance and strong shareholder returns. It has achieved Dividend King status, having raised its dividend for nearly seventy consecutive years. Today, GPC operates in over a dozen countries with more than 63,000 employees and supports over 10,800 distribution centers, 750 service centers, 195 branches, and nearly 9,900 retail locations.

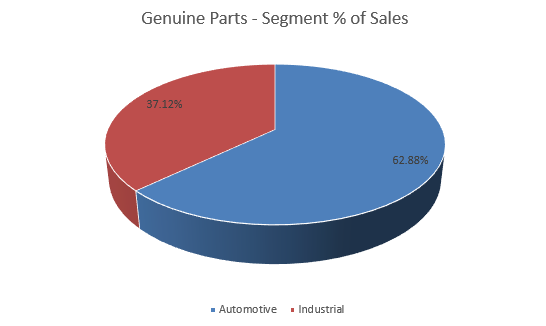

The business is organized into two major segments: the Automotive Parts Group and the Industrial Parts Group. The Automotive segment generates approximately 63% of GPC’s total revenue, while the Industrial segment, branded as Motion, accounts for the remaining 37%. The Automotive group primarily serves repair and maintenance shops that work on passenger and commercial vehicles. The Industrial segment supports businesses involved in manufacturing, production, logistics, and infrastructure, helping them maintain and operate their equipment efficiently.