Expedia Group (EXPE)

Key Statistics

EV/EBIT = 20.87x

ROE = 41.76%

Debt/Equity = 428%

FCF Yield = 9%

Dividend Yield = 0%

Market Cap = $18.88 billion

The Company

Expedia Group is online travel agency, connecting people to travel experiences through a diverse range of services including lodging, flights, rental cars, and activities.

Among their notable travel websites are Expedia.com, Hotels.com, Vrbo (a rival to Airbnb), Orbitz, Travelocity, Hotwire, and ebookers (a prominent European platform).

With their portfolio of popular travel websites, they offer over 3 million lodging options and flights, providing customers with a vast selection to meet their travel needs.

Expedia works with a variety of travel suppliers like hotels, airlines, car rental companies, and cruise lines. They aim to establish long-term relationships with these partners and help them increase revenue while reducing marketing costs. Expedia offers tools and technology to suppliers to manage and market their offerings efficiently.

In 2023, lodging, including hotels and alternative accommodations, made up 80% of Expedia Group's revenue.

They use various channels like online and offline advertising, loyalty programs, mobile apps, and social media to reach travelers. They've recently combined their loyalty programs into one called One Key to offer rewards across all major brands.

Expedia collaborates with Global Distribution Systems (GDSs) such as Amadeus and Sabre, enhancing its travel offerings for customers. These GDSs provide technology platforms connecting travel suppliers with agencies. Amadeus offers reservation systems and hotel distribution, while Sabre provides similar services, enabling global bookings for flights, car rentals, and more. Through these partnerships, Expedia broadens its selection of travel options.

Expedia's primary competitor is Booking Holdings, which boasts a portfolio including booking.com, Priceline, Agoda, and Kayak. As the industry leader, Booking Holdings reported $21 billion in revenue for 2023, surpassing Expedia's $12 billion.

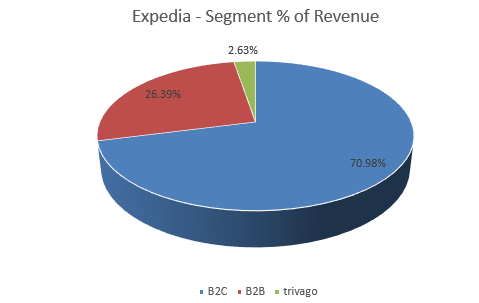

Expedia Group operates in two main segments: Business-to-Consumer (B2C) and Business-to-Business (B2B).