Casey's General Stores (CASY)

Key Statistics

EV/EBIT = 21.42x

ROE = 16.96%

Debt/Equity = 56%

FCF Yield = 2.61%

Dividend Yield = .53%

Market Cap = $13.79 billion

The Company

Casey’s General Stores (CASY) is a prominent operator of gas station convenience stores, with a strong concentration in the Midwest, particularly in Iowa, Missouri, and Illinois.

With 2,521 stores, Casey’s is the third-largest convenience store chain and the fifth-largest pizza chain in the United States. The company has shown impressive growth, expanding from 1,749 stores a decade ago to its current count, highlighting its strategic expansion efforts.

The origins of Casey’s date back to 1968 when the first store opened as a general store. Over the decades, the company has grown steadily, going public in 1983 and reaching 1,000 locations by the 1990s. This growth trajectory has positioned Casey’s as a significant player in the convenience store industry.

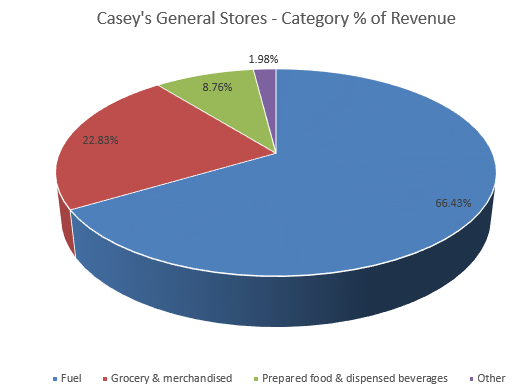

Gasoline sales constitute a significant portion of Casey’s revenue, currently accounting for 66% of total revenue. However, gasoline is a low-margin product.

The company's strategy is to attract customers to their stores with fuel and then entice them to purchase higher-margin items like prepared food. Prepared food, in particular, boasts an average profit margin of around 59%, compared to just 12% for fuel sales.

This focus on high-margin products aligns with Casey’s broader strategy to boost profitability through non-fuel retail sales. Over the past three fiscal years, non-fuel items have generated about 37% of Casey’s total revenue but have accounted for approximately 66% of the revenue after subtracting the cost of goods sold (excluding depreciation and amortization).