Asbury Automotive Group (ABG)

Key Statistics

EV/EBIT = 6.8x

ROE = 12.76%

Debt/Equity = 138%

FCF Yield = 3.2%

Dividend Yield = 0%

Market Cap = $5.75 billion

The Company

Asbury Automotive Group, Inc. is a leading automotive retailer in the United States, known for its expansive network and diverse services.

Asbury’s business model is selling vehicles to attract customers and driving profitability through high-margin offerings like financing, insurance, and repair services.

The company offers new and used cars, vehicle repair and maintenance, replacement parts, and collision repair services. It also provides finance and insurance (F&I) products, a critical profit driver for the business.

By the end of 2023, Asbury operated 208 new vehicle franchises across 31 brands, with 158 dealerships, 37 collision centers, and a specialized finance and insurance service called Total Care Auto (TCA), spread across 16 states. This broad network supports Asbury's mission to meet the needs of customers throughout the vehicle ownership lifecycle.

Asbury’s dealership network includes several prominent groups that form the backbone of its operations. The Larry H. Miller Dealerships stand out as one of the largest, with 44 owned and four leased dealerships, along with seven owned and two leased collision centers. The Koons Automotive Group follows with 18 owned and two leased dealerships, plus five owned and one leased collision centers. Nalley Automotive Group contributes 16 owned and one leased dealership, supported by four owned and one leased collision centers.

Other key players include Coggin Automotive Group, with 12 owned and four leased dealerships, and Park Place Automotive, which operates five owned and four leased dealerships. Additional dealership groups, like Hare, Bill Estes & Kahlo Automotive Groups and Greenville Automotive Group, further enhance Asbury’s reach, each bringing their own unique strengths and offerings to the table.

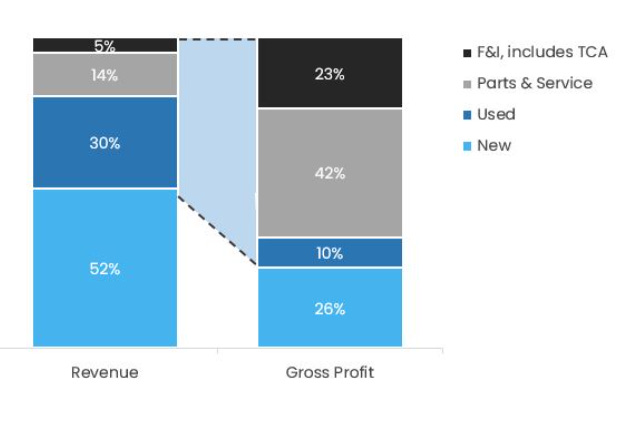

Revenue generation at Asbury comes from several key streams, with the company maximizing profitability through its varied business model. While vehicle sales—both new and used—account for 72% of revenue, they contribute only 36% of gross profit. Instead, F&I products and parts and service operations are the real profit engines. F&I, although just 5% of total revenue, provides a remarkable 23% of gross profits. Similarly, parts and service, which represent 14% of revenue, account for a significant 42% of gross profits.