Amazon (AMZN)

Key Statistics

EV/EBIT = 29.6x

ROE = 25.24%

Debt/Equity = 49%

FCF Yield = 1.35%

Dividend Yield = 0%

Market Cap = $2.181 trillion

The Company

Amazon (AMZN) is one of the most dominant and influential companies in the world today.

Known primarily for its vast online marketplace, it also plays a major role in cloud computing, logistics, and digital services. While most people think of Amazon as the place they buy books, groceries, or electronics, the company’s business model is much broader and more complex.

(Author’s note: I should have reviewed Amazon on this site a long time ago—but better late than never!)

Amazon earns revenue through a wide range of business activities. These include direct online sales, services for third-party sellers who use its platform, subscription fees like Amazon Prime, digital advertising, and Amazon Web Services (AWS), its cloud computing division.

In addition, Amazon earns revenue from its logistics and shipping services, Kindle e-books, Alexa-enabled devices, and physical retail locations like Whole Foods and Amazon Go.

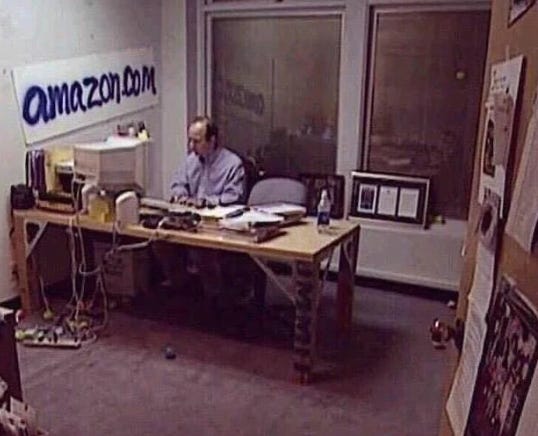

Amazon was founded in July 1994 by Jeff Bezos, a former Wall Street hedge fund executive. Bezos left a stable and lucrative career to pursue what he called his “regret minimization framework”—his personal strategy for ensuring he wouldn’t look back one day and regret not taking a risk on the internet boom.

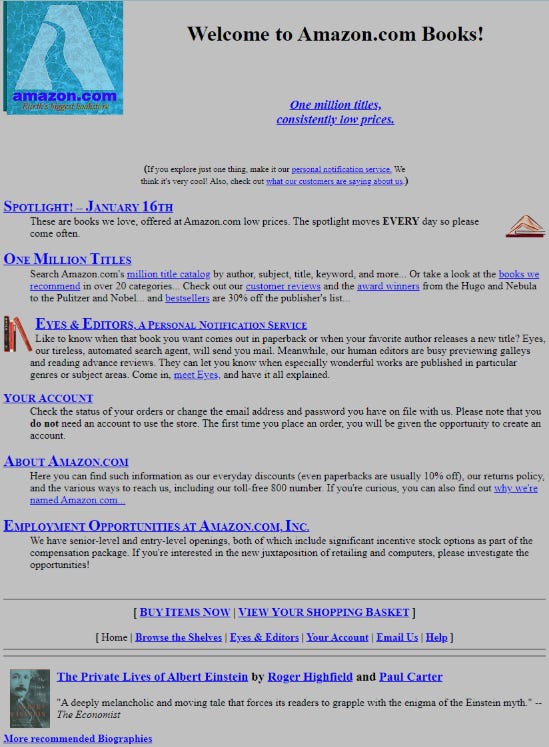

At the time, the internet was still in its infancy, but Bezos recognized its massive potential. He chose to start with books because they were easy to catalog and had universal demand.

From his garage in Bellevue, Washington, Bezos launched Amazon.com in July 1995.

The site gained early traction and quickly expanded beyond books to include CDs, DVDs, electronics, toys, and household goods. Bezos had a bold and often-quoted goal: to make Amazon “the everything store.”

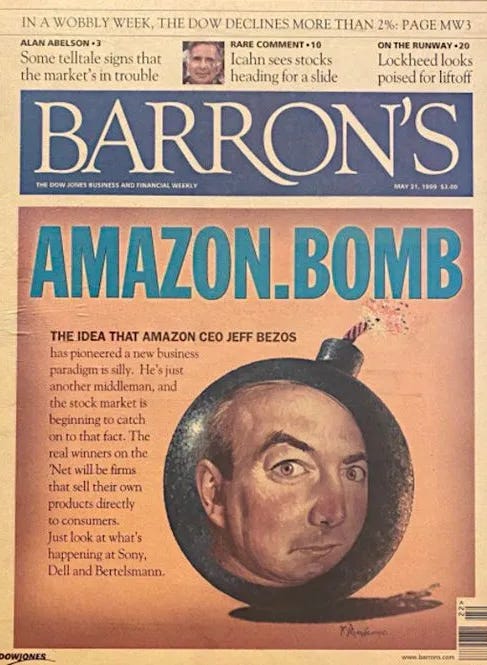

Unlike many dot-com companies that rose quickly and collapsed just as fast, Amazon adopted a long-term, patient growth strategy. For years, the company reinvested nearly all of its revenue into expanding operations, developing infrastructure, and enhancing customer experience—even if that meant sacrificing short-term profitability.

This approach often clashed with Wall Street’s expectations, resulting in periods of significant stock price volatility. However, Jeff Bezos remained unfazed by market fluctuations. He consistently prioritized the company’s long-term vision over quarterly results, a mindset that ultimately laid the foundation for Amazon’s enduring success.

One of the most game-changing moves in Amazon’s history came in 2006 with the launch of Amazon Web Services (AWS). It didn’t begin as a revenue-generating product. Instead, AWS was created to solve a major problem inside Amazon itself.